Agency theory is a fundamental concept in the field of economics and management, providing valuable insights into the dynamics of principal-agent relationships in various business settings. It explores the challenges and solutions associated with aligning the interests of principals (owners or stakeholders) and agents (individuals or entities entrusted with decision-making authority) when there is a separation of ownership and control.

What is Agency Theory?

Agency theory, developed in the 1970s by economists Michael Jensen and William Meckling, examines the conflicts of interest and challenges that occur when one party (the principal) delegates work to another party (the agent). The theory addresses the issues arising from the principal-agent relationship, particularly the problems of moral hazard and adverse selection.

Key Characteristics of Agency Theory

- Principal-Agent Relationship: Focuses on the relationship between principals (owners) and agents (managers).

- Information Asymmetry: Highlights the information gap between principals and agents.

- Conflict of Interest: Examines conflicts due to differing goals and incentives.

Importance of Understanding Agency Theory

Understanding and addressing agency theory is crucial for enhancing organizational governance, aligning interests, and ensuring effective management.

Enhancing Organizational Governance

- Accountability: Promotes accountability by addressing the conflicts of interest between principals and agents.

- Transparency: Encourages transparency in management practices and decision-making.

Aligning Interests

- Incentive Structures: Helps design incentive structures that align the interests of principals and agents.

- Performance Measurement: Provides frameworks for measuring and monitoring agent performance.

Ensuring Effective Management

- Risk Management: Identifies and mitigates risks associated with moral hazard and adverse selection.

- Decision-Making: Enhances decision-making processes by addressing information asymmetry.

Components of Agency Theory

Agency theory involves several key components that contribute to understanding and managing the principal-agent relationship.

1. Principal

- Owner: The individual or entity that delegates work to an agent.

- Goals: Seeks to maximize returns and ensure effective management of resources.

2. Agent

- Manager: The individual or entity that performs tasks on behalf of the principal.

- Responsibilities: Responsible for managing resources and making decisions in the best interest of the principal.

3. Information Asymmetry

- Knowledge Gap: The agent often has more information about the work and its execution than the principal.

- Impact: Can lead to misaligned interests and suboptimal decision-making.

4. Moral Hazard

- Risk-Taking: Agents may take on excessive risks knowing that the principal bears the consequences.

- Effort: Agents may exert less effort than desired by the principal.

5. Adverse Selection

- Hidden Information: Principals may not have complete information about the agent’s capabilities and intentions.

- Selection Bias: Agents may be selected based on incomplete or misleading information.

Causes of Agency Problems

Several factors contribute to agency problems, primarily revolving around information asymmetry, differing incentives, and risk preferences.

1. Information Asymmetry

- Hidden Actions: Agents may take actions that are not observable by the principal.

- Incomplete Information: Principals may lack complete information about the agent’s performance and behavior.

2. Differing Incentives

- Goal Misalignment: Agents and principals may have different goals and priorities.

- Incentive Structures: Misaligned incentive structures can exacerbate conflicts of interest.

3. Risk Preferences

- Risk Aversion: Principals and agents may have different attitudes toward risk.

- Risk-Sharing: Inappropriate risk-sharing arrangements can lead to moral hazard.

4. Monitoring Challenges

- Cost of Monitoring: Effective monitoring of agents can be costly and challenging for principals.

- Imperfect Monitoring: Incomplete or imperfect monitoring can lead to agency problems.

Effects of Agency Problems

Agency problems have significant and far-reaching effects on various aspects of organizational performance and governance.

Organizational Impact

- Inefficiency: Inefficient resource allocation and decision-making due to misaligned interests.

- Performance Decline: Decline in overall organizational performance and effectiveness.

Financial Impact

- Increased Costs: Higher costs associated with monitoring and controlling agents.

- Reduced Returns: Lower returns on investment due to suboptimal decisions and actions by agents.

Trust and Morale

- Reduced Trust: Erosion of trust between principals and agents.

- Lower Morale: Decreased employee morale and motivation due to perceived unfairness or lack of accountability.

Historical Examples of Agency Problems

Several historical examples illustrate agency problems and their impact on organizations.

Corporate Scandals

- Enron: The Enron scandal highlighted severe agency problems, including accounting fraud and misleading financial reporting.

- WorldCom: Similar issues at WorldCom involved financial misstatements and fraudulent activities by management.

Financial Crisis

- 2008 Financial Crisis: The financial crisis exposed agency problems in the banking and mortgage industries, including excessive risk-taking and lack of oversight.

Executive Compensation

- Excessive Pay: Disproportionate executive compensation packages that do not align with company performance or shareholder interests.

Methods to Address Agency Problems

Several methods can be used to address agency problems effectively, each offering different strategies and tools.

1. Incentive Alignment

- Performance-Based Pay: Linking compensation to performance metrics to align interests.

- Stock Options: Providing stock options to align the financial interests of agents with those of principals.

2. Monitoring and Control

- Board Oversight: Strengthening board oversight and governance to monitor agent behavior.

- Auditing: Regular audits to ensure transparency and accountability in financial reporting.

3. Contract Design

- Clear Contracts: Designing clear and detailed contracts that outline expectations, responsibilities, and consequences.

- Incentive Clauses: Including incentive clauses that reward desired behaviors and outcomes.

4. Information Disclosure

- Transparency: Promoting transparency through regular and detailed information disclosure.

- Reporting Systems: Implementing robust reporting systems to keep principals informed.

5. Risk Management

- Risk Sharing: Developing appropriate risk-sharing arrangements to align risk preferences.

- Risk Controls: Implementing risk controls to prevent excessive risk-taking by agents.

Benefits of Addressing Agency Problems

Addressing agency problems offers numerous benefits, enhancing organizational governance, performance, and stakeholder trust.

Improved Governance

- Accountability: Promotes accountability by aligning the interests of principals and agents.

- Transparency: Enhances transparency in management practices and decision-making.

Enhanced Performance

- Efficiency: Improves resource allocation and decision-making efficiency.

- Profitability: Increases profitability by ensuring that agents act in the best interest of principals.

Increased Trust

- Stakeholder Confidence: Builds confidence among stakeholders, including shareholders, employees, and customers.

- Reputation: Protects and enhances the organization’s reputation.

Challenges of Addressing Agency Problems

Despite its benefits, addressing agency problems presents several challenges that need to be managed for successful implementation.

Enforcement Issues

- Regulatory Compliance: Ensuring compliance with regulatory requirements and governance standards.

- Monitoring Costs: Managing the costs associated with effective monitoring and oversight.

Coordination Difficulties

- Stakeholder Alignment: Aligning the interests and incentives of diverse stakeholders.

- Implementation Complexity: Implementing complex governance and control mechanisms.

Resource Allocation

- Funding Mechanisms: Developing effective funding mechanisms to support monitoring and incentive alignment.

- Cost-Benefit Analysis: Conducting cost-benefit analysis to balance monitoring costs with expected benefits.

Public Resistance

- Behavioral Change: Encouraging behavioral change and adoption of aligned incentive structures.

- Trust Building: Building trust in new governance mechanisms and practices.

Best Practices for Addressing Agency Problems

Implementing best practices can help effectively manage and overcome challenges, maximizing the benefits of addressing agency problems.

Foster Transparency

- Full Disclosure: Promote full disclosure of information to reduce information asymmetry.

- Open Communication: Encourage open communication between principals and agents.

Align Incentives

- Performance-Based Compensation: Implement performance-based compensation to align interests.

- Long-Term Focus: Design incentive structures that promote long-term value creation.

Strengthen Oversight

- Board Governance: Strengthen board governance and oversight to monitor agent behavior.

- Independent Audits: Conduct independent audits to ensure transparency and accountability.

Promote Ethical Culture

- Ethical Standards: Establish and enforce high ethical standards within the organization.

- Training Programs: Implement training programs to promote ethical behavior and decision-making.

Leverage Technology

- Digital Tools: Use digital tools to facilitate transparency, communication, and monitoring.

- Data Analytics: Employ data analytics to monitor performance and identify potential agency problems.

Future Trends in Managing Agency Problems

Several trends are likely to shape the future of managing agency problems and ensuring effective governance and performance.

Digital Transformation

- Blockchain Technology: Leveraging blockchain for transparent and secure tracking of transactions and performance.

- Online Platforms: Using online platforms to facilitate communication and monitoring.

Sustainable Practices

- Sustainability Metrics: Integrating sustainability metrics into performance evaluation and incentive structures.

- ESG Standards: Promoting environmental, social, and governance (ESG) standards.

Global Collaboration

- International Standards: Developing and adopting international governance standards to address global agency problems.

- Cross-Border Regulation: Enhancing cross-border regulatory collaboration to enforce governance standards.

Behavioral Economics

- Nudge Theory: Applying nudge theory to encourage desired behaviors and align interests.

- Behavioral Insights: Using behavioral insights to design effective governance mechanisms.

Policy Innovation

- Adaptive Policies: Developing adaptive policies that can respond to changing market conditions and emerging challenges.

- Inclusive Governance: Promoting inclusive governance to ensure all stakeholders are involved in addressing agency problems.

Conclusion

Agency theory is a significant concept in economics and organizational management that addresses the conflicts and challenges arising from the principal-agent relationship. By understanding the key components, causes, effects, and historical examples of agency problems, policymakers, organizations, and managers can develop effective strategies to address and mitigate its impact. Implementing best practices such as fostering transparency, aligning incentives, strengthening oversight, promoting an ethical culture, and leveraging technology can help maximize the benefits of addressing agency problems.

Read Next: Organizational Structure.

Types of Organizational Structures

Siloed Organizational Structures

Functional

Divisional

Open Organizational Structures

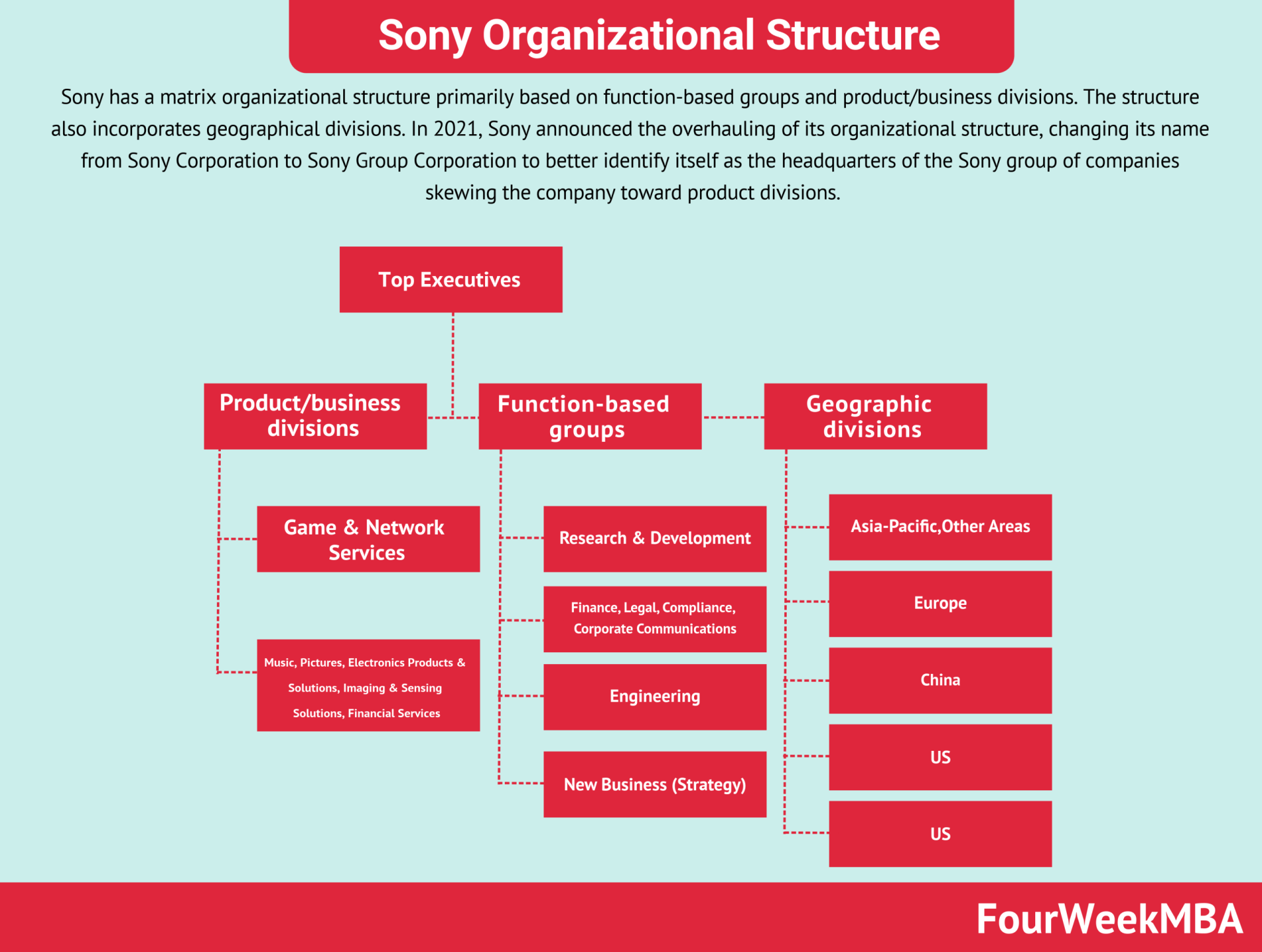

Matrix

Flat

Connected Business Frameworks

Nadler-Tushman Congruence Model

McKinsey’s Seven Degrees of Freedom

Organizational Structure Case Studies

OpenAI Organizational Structure

Airbnb Organizational Structure

Amazon Organizational Structure

Apple Organizational Structure

Coca-Cola Organizational Structure

Costco Organizational Structure

Facebook Organizational Structure

Goldman Sachs’ Organizational Structure

Google Organizational Structure

McDonald’s Organizational Structure

McKinsey Organizational Structure

Microsoft Organizational Structure

Nestlé Organizational Structure

Patagonia Organizational Structure

Samsung Organizational Structure

Starbucks Organizational Structure

Tesla Organizational Structure

Toyota Organizational Structure

Walmart Organizational Structure

Main Free Guides: