Shareholder democracy refers to the practice of allowing shareholders of a corporation to have a say in the company’s decision-making processes, typically through voting on key matters. It is a fundamental aspect of corporate governance that ensures transparency, accountability, and fairness in the way a company operates.

The main mechanisms through which shareholder democracy is exercised include:

- Annual General Meetings (AGMs): Shareholders gather at these meetings to vote on various matters, including the election of directors, executive compensation, and other significant corporate policies.

- Proxy Voting: Shareholders who cannot attend AGMs in person can appoint a proxy to vote on their behalf. Proxy votes are essential in large corporations where individual shareholders may not be able to attend meetings.

- Shareholder Resolutions: Shareholders can propose resolutions for consideration at AGMs. These resolutions can cover a wide range of issues, from environmental and social concerns to corporate governance reforms.

- Board of Directors: Shareholders elect members of the board of directors, who are responsible for overseeing the company’s management and making strategic decisions.

- Say-on-Pay: Some jurisdictions require companies to hold non-binding shareholder votes on executive compensation packages, giving shareholders a say in how top executives are paid.

Shareholder democracy ensures that shareholders, as owners of the company, have a voice in critical corporate decisions. It is a crucial mechanism for safeguarding their interests and holding corporate management accountable.

What is Shareholder Democracy?

Shareholder democracy refers to the mechanisms and processes that allow shareholders to exercise their rights and influence corporate governance. It involves shareholders having a say in key decisions, such as electing board members, approving major corporate actions, and influencing executive compensation.

Key Characteristics of Shareholder Democracy

- Active Participation: Encourages shareholders to actively participate in corporate governance.

- Voting Rights: Provides shareholders with voting rights on important corporate matters.

- Transparency: Ensures transparency in the decision-making processes.

- Accountability: Holds management accountable to shareholders.

Importance of Understanding Shareholder Democracy

Understanding and implementing shareholder democracy is crucial for enhancing corporate governance, improving accountability, and ensuring that the interests of shareholders are considered in corporate decisions.

Enhancing Corporate Governance

- Balanced Power: Balances the power between shareholders and management.

- Ethical Practices: Promotes ethical practices and decision-making.

Improving Accountability

- Management Accountability: Ensures that management is accountable to shareholders.

- Performance Monitoring: Allows shareholders to monitor and influence corporate performance.

Ensuring Shareholder Interests

- Interest Alignment: Aligns corporate actions with the interests of shareholders.

- Stakeholder Engagement: Enhances engagement and communication with shareholders.

Components of Shareholder Democracy

Shareholder democracy involves several key components that contribute to effective governance and shareholder participation.

1. Voting Rights

- Proxy Voting: Mechanisms that allow shareholders to vote on corporate matters, either in person or by proxy.

- Major Decisions: Voting on key decisions, such as mergers, acquisitions, and board elections.

2. Annual General Meetings (AGMs)

- Shareholder Meetings: Regular meetings where shareholders can discuss and vote on important issues.

- Information Disclosure: Transparent disclosure of financial and operational information.

3. Board of Directors

- Board Elections: Shareholders have the right to elect and remove board members.

- Board Accountability: The board is accountable to shareholders for corporate governance.

4. Shareholder Proposals

- Proposal Submission: Mechanisms for shareholders to submit proposals for consideration at AGMs.

- Proposal Voting: Shareholders vote on submitted proposals during AGMs.

5. Communication and Transparency

- Information Access: Ensuring shareholders have access to relevant and timely information.

- Transparent Processes: Clear and transparent processes for decision-making and information dissemination.

6. Regulatory Framework

- Legal Rights: Legal framework protecting shareholders’ rights and ensuring fair treatment.

- Regulatory Compliance: Compliance with regulatory requirements and governance standards.

Implementation Methods for Shareholder Democracy

Several methods can be used to implement shareholder democracy effectively, each offering different strategies and tools.

1. Enhancing Voting Mechanisms

- Electronic Voting: Implementing electronic voting systems to facilitate shareholder participation.

- Proxy Voting: Allowing proxy voting to ensure that all shareholders can exercise their voting rights.

2. Improving AGM Processes

- Virtual AGMs: Offering virtual AGMs to increase accessibility and participation.

- Interactive Sessions: Providing interactive sessions during AGMs for shareholder questions and feedback.

3. Strengthening Board Accountability

- Independent Directors: Ensuring a significant proportion of independent directors on the board.

- Board Evaluations: Conducting regular board evaluations to assess performance and accountability.

4. Facilitating Shareholder Proposals

- Clear Guidelines: Establishing clear guidelines for submitting and evaluating shareholder proposals.

- Proposal Review: Implementing a transparent process for reviewing and voting on shareholder proposals.

5. Enhancing Communication

- Regular Updates: Providing regular updates on corporate performance and governance matters.

- Investor Relations: Establishing robust investor relations programs to engage with shareholders.

6. Ensuring Regulatory Compliance

- Legal Framework: Adhering to legal requirements and governance codes that protect shareholder rights.

- Compliance Monitoring: Regularly monitoring compliance with regulatory standards.

Benefits of Shareholder Democracy

Implementing shareholder democracy offers numerous benefits, enhancing corporate governance, improving accountability, and ensuring shareholder interests are prioritized.

Enhanced Corporate Governance

- Balanced Power: Balances power between shareholders and management.

- Ethical Practices: Promotes ethical practices and decision-making.

Improved Accountability

- Management Oversight: Enhances oversight of management actions and decisions.

- Performance Monitoring: Allows shareholders to monitor and influence corporate performance.

Increased Shareholder Engagement

- Active Participation: Encourages active participation and engagement from shareholders.

- Stakeholder Trust: Builds trust and confidence among shareholders.

Better Decision-Making

- Diverse Perspectives: Incorporates diverse perspectives in decision-making processes.

- Informed Choices: Ensures decisions are made based on comprehensive and transparent information.

Long-Term Value Creation

- Sustainable Practices: Promotes sustainable business practices that support long-term growth.

- Risk Management: Helps identify and mitigate risks through shareholder input.

Challenges of Implementing Shareholder Democracy

Despite its benefits, implementing shareholder democracy presents several challenges that need to be managed for successful implementation.

Resistance to Change

- Management Resistance: Overcoming resistance from management to increased shareholder influence.

- Cultural Change: Encouraging a cultural shift towards greater shareholder involvement.

Complexity of Implementation

- Voting Systems: Implementing and managing effective voting systems.

- Proposal Evaluation: Establishing fair and transparent processes for evaluating shareholder proposals.

Ensuring Effective Communication

- Information Overload: Managing the volume of information provided to shareholders.

- Clear Communication: Ensuring clear and understandable communication of complex issues.

Maintaining Engagement

- Consistent Participation: Encouraging consistent and active participation from shareholders.

- Avoiding Apathy: Addressing potential shareholder apathy and disengagement.

Balancing Interests

- Conflict of Interests: Balancing the interests of different shareholder groups.

- Short-Term vs. Long-Term: Aligning short-term actions with long-term value creation.

Best Practices for Implementing Shareholder Democracy

Implementing best practices can help effectively manage and overcome challenges, maximizing the benefits of shareholder democracy.

Foster a Culture of Engagement

- Inclusive Culture: Promote a culture that values shareholder engagement and participation.

- Leadership Example: Ensure that leaders demonstrate a commitment to shareholder democracy.

Enhance Communication

- Transparent Communication: Maintain transparent communication to build trust and reduce uncertainty.

- Regular Updates: Provide regular updates on corporate performance and governance matters.

Align Goals and Incentives

- Unified Goals: Ensure that corporate goals and objectives are aligned with shareholder interests.

- Aligned Incentives: Align executive incentives with long-term shareholder value creation.

Promote Leadership and Vision

- Strategic Leadership: Encourage strategic leadership to oversee shareholder engagement and governance.

- Clear Vision: Develop and communicate a clear and unified vision for the organization.

Implement Robust Monitoring and Evaluation

- Performance Metrics: Develop and track performance metrics to measure the effectiveness of shareholder democracy practices.

- Continuous Improvement: Establish mechanisms for continuous feedback and improvement.

Future Trends in Shareholder Democracy

Several trends are likely to shape the future of shareholder democracy and its applications.

Digital Transformation

- Electronic Voting: Leveraging electronic voting to enhance shareholder participation.

- Virtual AGMs: Offering virtual AGMs to increase accessibility and engagement.

Sustainability

- ESG Integration: Integrating environmental, social, and governance (ESG) considerations into shareholder democracy practices.

- Sustainable Practices: Promoting sustainable business practices through shareholder engagement.

Globalization

- Global Standards: Developing global standards for shareholder democracy to support international operations.

- Cross-Border Engagement: Enhancing cross-border shareholder engagement and participation.

Stakeholder Engagement

- Inclusive Governance: Promoting inclusive governance that considers the interests of all stakeholders.

- Stakeholder Communication: Enhancing communication and engagement with stakeholders.

Agile Methodologies

- Agile Governance: Implementing agile methodologies to enhance flexibility and responsiveness in governance practices.

- Iterative Processes: Using iterative processes to continuously improve and adapt shareholder democracy practices.

Conclusion

Shareholder democracy is a governance model that emphasizes the active participation and influence of shareholders in corporate decision-making. By understanding the key components, implementation methods, benefits, and challenges of shareholder democracy, organizations can develop effective strategies to enhance corporate governance, improve accountability, and ensure shareholder interests are prioritized. Implementing best practices such as fostering a culture of engagement, enhancing communication, aligning goals and incentives, promoting leadership and vision, and implementing robust monitoring and evaluation can help maximize the benefits of shareholder democracy.

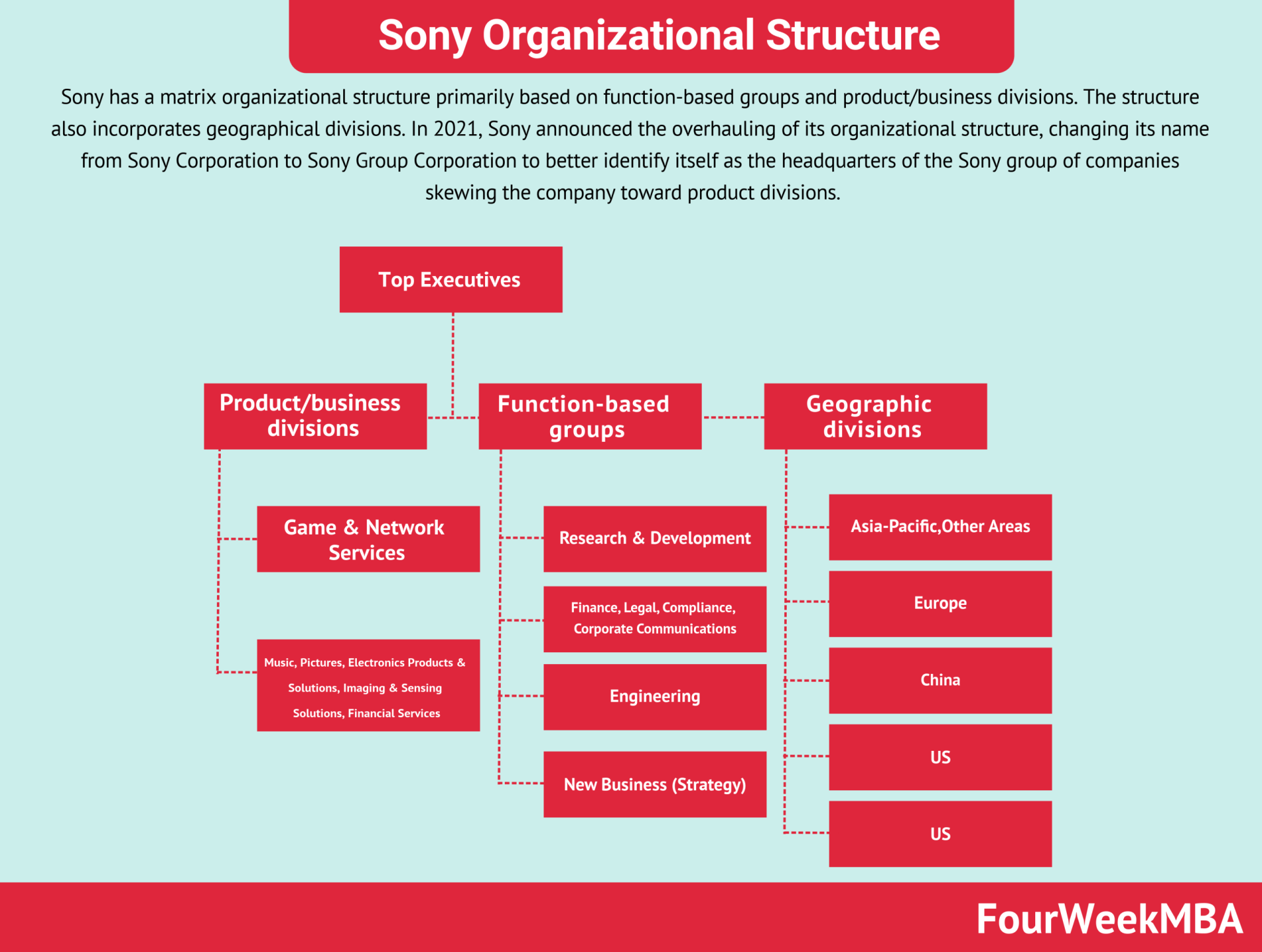

Read Next: Organizational Structure.

Types of Organizational Structures

Siloed Organizational Structures

Functional

Divisional

Open Organizational Structures

Matrix

Flat

Connected Business Frameworks

Nadler-Tushman Congruence Model

McKinsey’s Seven Degrees of Freedom

Organizational Structure Case Studies

OpenAI Organizational Structure

Airbnb Organizational Structure

Amazon Organizational Structure

Apple Organizational Structure

Coca-Cola Organizational Structure

Costco Organizational Structure

Facebook Organizational Structure

Goldman Sachs’ Organizational Structure

Google Organizational Structure

McDonald’s Organizational Structure

McKinsey Organizational Structure

Microsoft Organizational Structure

Nestlé Organizational Structure

Patagonia Organizational Structure

Samsung Organizational Structure

Starbucks Organizational Structure

Tesla Organizational Structure

Toyota Organizational Structure

Walmart Organizational Structure

Main Free Guides: