A holding company, often referred to as a parent company or umbrella company, is a complex organizational structure that plays a significant role in various industries and sectors. This business arrangement involves one company, the holding company, owning a significant portion of another company’s stock or assets, known as subsidiaries. The primary purpose of a holding company is not to engage in day-to-day operations but to exercise control and ownership over its subsidiaries.

Understanding the Holding Company Structure

The Essence of a Holding Company

At its core, a holding company is a type of business organization designed for the purpose of owning and controlling other companies. The holding company itself typically does not engage in the production of goods or services that its subsidiaries offer to consumers. Instead, its main function is to hold ownership stakes, manage assets, and exert influence over its subsidiaries.

Holding companies can take various forms, such as corporations, limited liability companies (LLCs), or partnerships, depending on the jurisdiction and the specific business needs of the organization.

Characteristics of a Holding Company

Several key characteristics distinguish a holding company structure:

- Ownership of Subsidiaries: The holding company owns a significant percentage of the equity or assets of one or more subsidiary companies.

- Limited Involvement in Operations: The holding company’s role is primarily strategic and financial, with minimal involvement in the day-to-day operations of its subsidiaries.

- Control and Influence: Through ownership, the holding company has control and influence over the strategic decisions and direction of its subsidiaries.

- Risk Management: A holding company structure can provide risk management benefits by isolating the assets and liabilities of different subsidiaries.

- Diversification: Holding companies often diversify their holdings across various industries and sectors to spread risk and enhance financial stability.

Advantages of a Holding Company Structure

A holding company organizational structure offers several advantages that can benefit both the holding company itself and its subsidiaries:

1. Risk Mitigation:

- By isolating the assets and liabilities of subsidiaries, a holding company can protect its core assets from the risks associated with specific business operations.

2. Strategic Focus:

- Holding companies can concentrate on strategic decision-making and portfolio management rather than getting bogged down in day-to-day operations.

3. Tax Benefits:

- Depending on the jurisdiction, holding companies may enjoy tax advantages, including reduced tax liability on dividends received from subsidiaries.

4. Investment Opportunities:

- Holding companies can access diverse investment opportunities by acquiring and managing subsidiaries in various industries.

5. Asset Protection:

- Assets held by a holding company are often shielded from the creditors of its subsidiaries, providing a level of asset protection.

Challenges of a Holding Company Structure

However, the holding company structure is not without its challenges:

1. Regulatory Complexity:

- Operating a holding company can be subject to complex regulatory requirements, particularly when subsidiaries operate in different industries or jurisdictions.

2. Capital Allocation:

- Allocating capital effectively among subsidiaries can be a complex task, requiring a deep understanding of each subsidiary’s needs and potential.

3. Potential for Conflict:

- Conflicts of interest can arise between the holding company and its subsidiaries, particularly when it comes to strategic decision-making and resource allocation.

4. Financial Transparency:

- Maintaining financial transparency and accountability across a diverse portfolio of subsidiaries can be challenging.

5. Succession Planning:

- Ensuring smooth succession planning and leadership transitions within the holding company and its subsidiaries is essential for long-term stability.

Real-World Implications

Holding companies have real-world implications across various industries and sectors:

1. Conglomerates:

- Many conglomerates, such as Berkshire Hathaway, are organized as holding companies, allowing them to own and manage diverse businesses ranging from insurance to manufacturing.

2. Asset Protection:

- Holding companies are used by individuals and businesses to protect valuable assets, such as real estate, from potential legal liabilities.

3. Mergers and Acquisitions:

- Holding companies often play a pivotal role in mergers and acquisitions, facilitating the acquisition of target companies without directly integrating them.

4. Family Businesses:

- Family-owned businesses sometimes adopt a holding company structure to separate ownership and management functions and facilitate generational wealth transfer.

5. Private Equity:

- Private equity firms frequently use holding company structures to manage a portfolio of investments in various companies.

Navigating the Holding Company Structure

Successfully navigating a holding company structure requires careful planning and attention to various factors:

- Legal and Regulatory Compliance: Comply with all legal and regulatory requirements for both the holding company and its subsidiaries, especially when operating in different jurisdictions.

- Strategic Portfolio Management: Develop a clear strategy for managing the portfolio of subsidiaries, including capital allocation, resource sharing, and risk assessment.

- Governance and Leadership: Establish effective governance mechanisms and leadership structures to ensure smooth decision-making and accountability.

- Financial Oversight: Implement robust financial oversight processes to maintain transparency and financial health across the organization.

- Succession Planning: Develop comprehensive succession plans for key leadership roles within the holding company and its subsidiaries.

Conclusion

A holding company organizational structure is a strategic arrangement that can offer risk mitigation, investment diversification, and strategic focus. While it presents challenges related to regulatory compliance, capital allocation, and potential conflicts, it has been successfully employed across diverse industries and sectors. As businesses and individuals continue to seek opportunities for asset protection, investment diversification, and strategic management, the concept of a holding company remains a viable and relevant option in the complex landscape of modern business and finance.

Key Highlights

- Understanding the Holding Company Structure:

- Holding companies are designed to own and control other companies without engaging in day-to-day operations.

- They can take various legal forms and primarily hold ownership stakes and assets of subsidiaries.

- Characteristics of a Holding Company:

- Ownership of subsidiaries, limited involvement in operations, control and influence over subsidiaries, risk management, and diversification are key characteristics.

- Advantages of a Holding Company Structure:

- Risk mitigation, strategic focus, tax benefits, investment opportunities, and asset protection are the main advantages.

- Challenges of a Holding Company Structure:

- Regulatory complexity, capital allocation, potential for conflict, financial transparency, and succession planning are the primary challenges.

- Real-World Implications:

- Holding companies are prevalent in conglomerates, asset protection strategies, mergers and acquisitions, family businesses, and private equity.

- Navigating the Holding Company Structure:

- Strategies include legal and regulatory compliance, strategic portfolio management, governance and leadership, financial oversight, and succession planning.

- Conclusion:

- Holding companies offer risk mitigation, investment diversification, and strategic focus.

- Despite challenges, they remain relevant in various industries and sectors for asset protection, investment management, and strategic control.

| Case Study | Strategy | Outcome |

|---|---|---|

| Berkshire Hathaway | Holding Company: Operates as a parent company owning a diverse portfolio of subsidiary businesses across various industries. | Achieved strong growth and profitability through strategic investments, decentralized management, and leveraging the strengths of subsidiary businesses. |

| Alphabet Inc. | Holding Company: Created as the parent company of Google and other subsidiaries focusing on different sectors like health, research, and technology. | Enhanced focus on core business areas, improved strategic flexibility, and facilitated innovation across various sectors. |

| Tata Group | Holding Company: Operates as a parent company with over 100 subsidiaries in industries ranging from steel to telecommunications. | Achieved diversification, risk management, and strong market presence through strategic investments and decentralized management. |

| Samsung Group | Holding Company: Operates as a parent company with numerous subsidiaries in electronics, construction, and finance. | Achieved significant market dominance and innovation across multiple industries through strategic oversight and resource allocation. |

| Johnson & Johnson | Holding Company: Operates with a portfolio of over 250 subsidiary companies in pharmaceuticals, medical devices, and consumer health products. | Enhanced innovation, market responsiveness, and operational efficiency, driving growth and maintaining high standards of quality. |

| Procter & Gamble | Holding Company: Manages a diverse portfolio of brands and subsidiaries across various product categories. | Improved market responsiveness, product innovation, and operational efficiency, driving strong brand loyalty and market share growth. |

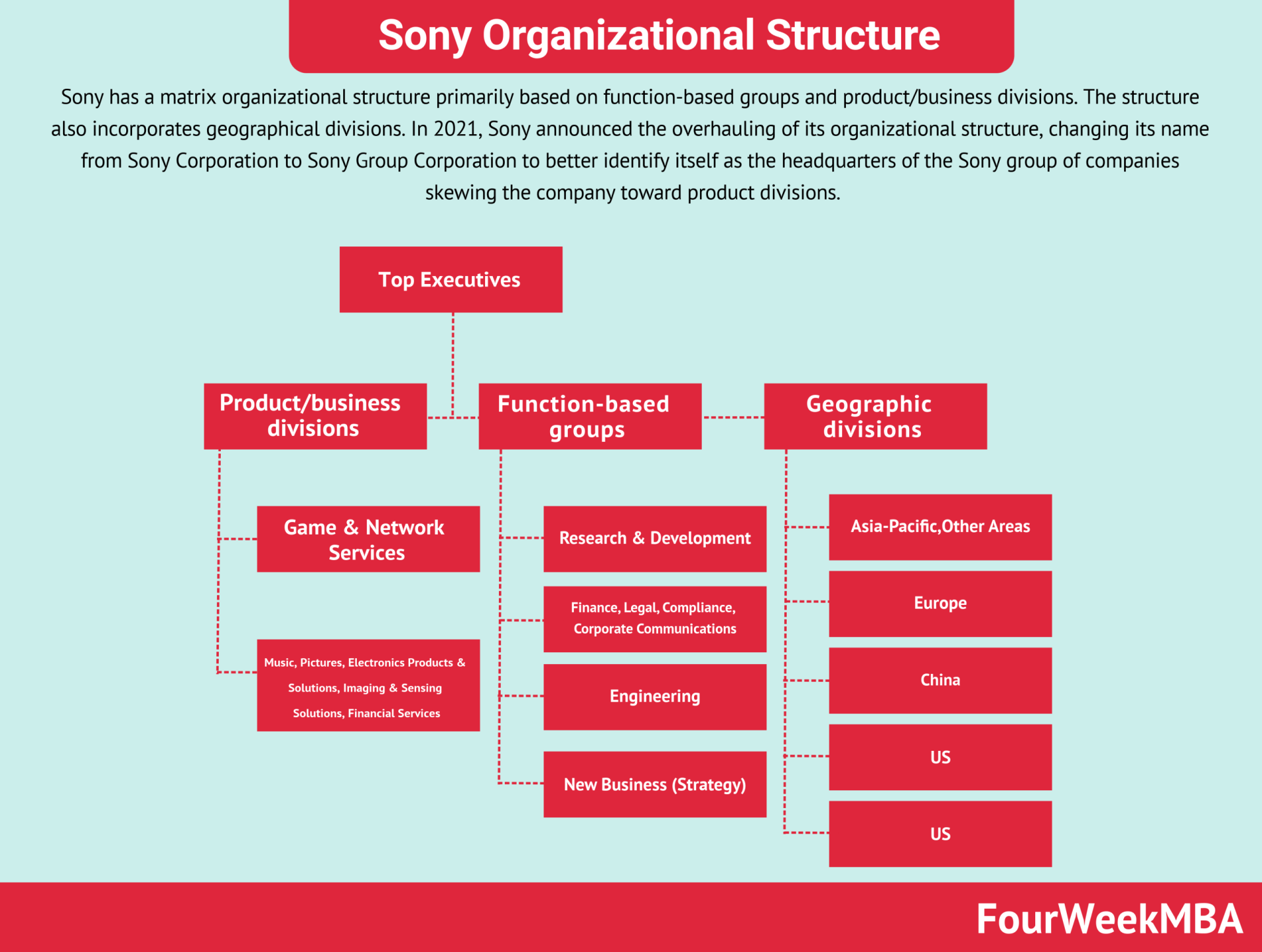

| Sony Corporation | Holding Company: Operates with a portfolio of subsidiaries in electronics, gaming, and entertainment. | Enhanced innovation, market responsiveness, and operational efficiency, driving strong performance across diverse product lines. |

| LG Corporation | Holding Company: Operates as a parent company with subsidiaries in electronics, chemicals, and telecommunications. | Achieved diversification, innovation, and strong market presence through strategic oversight and resource allocation. |

| Mitsubishi Group | Holding Company: Operates with numerous subsidiaries in sectors such as finance, electronics, and heavy industries. | Achieved significant market influence and stability through diversification and strategic investments. |

| Reliance Industries | Holding Company: Operates with subsidiaries in petrochemicals, refining, oil, telecommunications, and retail. | Achieved significant growth, diversification, and market leadership through strategic investments and operational efficiency. |

| SoftBank Group | Holding Company: Operates with a diverse portfolio of subsidiaries and investments in technology, finance, and telecommunications. | Enhanced market influence and innovation through strategic investments and acquisitions. |

| GE (General Electric) | Holding Company: Operates with a diverse portfolio of subsidiaries in sectors such as aviation, healthcare, and energy. | Achieved operational efficiency, innovation, and market responsiveness through strategic oversight and resource allocation. |

| Toshiba Corporation | Holding Company: Operates with subsidiaries in electronics, energy, and infrastructure. | Enhanced innovation, operational efficiency, and market responsiveness through strategic investments and resource management. |

| Danaher Corporation | Holding Company: Manages a portfolio of subsidiaries in life sciences, diagnostics, and industrial technologies. | Achieved growth and innovation through strategic acquisitions and decentralized management. |

| Honeywell International | Holding Company: Operates with a portfolio of subsidiaries in aerospace, building technologies, and performance materials. | Enhanced innovation, operational efficiency, and market responsiveness through strategic oversight and resource allocation. |

| Hitachi Ltd. | Holding Company: Operates with subsidiaries in information technology, infrastructure, and electronics. | Achieved growth, diversification, and market leadership through strategic investments and resource management. |

| CK Hutchison Holdings | Holding Company: Operates with subsidiaries in ports, retail, infrastructure, energy, and telecommunications. | Enhanced market influence and operational efficiency through diversification and strategic investments. |

| Exor N.V. | Holding Company: Manages a diverse portfolio of subsidiaries and investments in automotive, media, and financial services. | Achieved growth, diversification, and market influence through strategic acquisitions and decentralized management. |

| United Technologies Corporation | Holding Company: Operated with subsidiaries in aerospace, building systems, and industrial products. | Enhanced innovation, operational efficiency, and market responsiveness through strategic oversight and resource allocation. |

| Related Organizational Structures | Description | Implications |

|---|---|---|

| Holding Company Organizational Structure | A Holding Company Organizational Structure is characterized by a parent company that owns controlling interests in subsidiary companies. Each subsidiary operates as a separate legal entity with its own management and operations but is controlled by the holding company through ownership of its shares or assets. Holding companies often provide strategic direction, financial support, and governance oversight to subsidiaries while allowing them to maintain operational autonomy and flexibility. | Holding Company Organizational Structures offer several benefits, including risk diversification, resource sharing, and operational synergies. By owning multiple subsidiaries across different industries or markets, holding companies can spread risk and leverage economies of scale. Holding structures enable centralized management and governance oversight, allowing the parent company to set strategic direction, allocate resources, and monitor performance across subsidiaries. However, holding structures may also pose challenges related to coordination, integration, and governance, as subsidiaries may have diverse operations, cultures, and objectives. |

| Conglomerate Organizational Structure | A Conglomerate Organizational Structure is similar to a holding structure but involves the ownership of unrelated businesses or entities. Conglomerates diversify their portfolio by investing in companies operating in different industries or sectors. Each business unit operates independently, with its own management and operations, but benefits from centralized support and oversight from the conglomerate. Conglomerates aim to achieve synergies, economies of scale, and risk diversification through their diversified portfolio of businesses. | Conglomerate Organizational Structures share similarities with Holding Structures in their emphasis on diversification and centralization. By owning unrelated businesses, conglomerates can spread risk and leverage synergies across different industries or markets. Conglomerates provide centralized support and oversight, enabling them to allocate resources, share best practices, and monitor performance across business units. However, conglomerates may face challenges related to integration, coordination, and strategic alignment, as businesses may have different operating models, cultures, and objectives. To maximize the benefits of diversification, conglomerates need to implement effective governance mechanisms, resource allocation processes, and strategic planning frameworks to ensure alignment and value creation across their portfolio. |

| Mergers and Acquisitions (M&A) | Mergers and Acquisitions (M&A) involve the consolidation of companies through various transactions, such as mergers, acquisitions, or divestitures. M&A activities enable organizations to expand their operations, diversify their portfolio, and achieve strategic objectives, such as market expansion, product innovation, or cost reduction. M&A transactions may involve the integration of companies into an existing organizational structure or the creation of a new structure to accommodate the combined entities. M&A activities require thorough due diligence, strategic planning, and integration efforts to realize synergies and value creation. | Mergers and Acquisitions (M&A) share similarities with Holding Company Structures in their focus on consolidation and diversification. By acquiring or merging with other companies, organizations can expand their footprint, diversify their portfolio, and achieve strategic objectives. M&A activities enable organizations to leverage complementary strengths, assets, and capabilities to create value and drive growth. However, M&A transactions may also pose challenges related to integration, cultural alignment, and organizational change, as companies may have different operating models, cultures, and objectives. To maximize the benefits of M&A activities, organizations need to implement effective integration strategies, communication plans, and change management initiatives to ensure alignment and value creation across the combined entity. |

| Strategic Alliance | A Strategic Alliance is a cooperative relationship between two or more organizations to pursue shared objectives or opportunities. Strategic alliances enable organizations to leverage each other’s strengths, resources, and capabilities to achieve mutual benefits, such as market expansion, innovation, or cost savings. Strategic alliances may take various forms, such as joint ventures, partnerships, or licensing agreements, depending on the nature of the collaboration and the desired outcomes. Strategic alliances require clear objectives, trust, and collaboration to succeed and create value for all parties involved. | Strategic Alliances share similarities with Holding Structures in their focus on collaboration and shared objectives. By forming alliances with other organizations, companies can access complementary strengths, resources, and markets to achieve mutual benefits. Strategic alliances enable organizations to leverage each other’s expertise, networks, and capabilities to pursue shared opportunities or address common challenges. However, strategic alliances may also pose challenges related to alignment, trust, and governance, as partners may have different interests, cultures, and objectives. To maximize the benefits of strategic alliances, organizations need to establish clear objectives, communication channels, and governance mechanisms to ensure alignment and value creation for all parties involved. |

Read Next: Organizational Structure.

Types of Organizational Structures

Siloed Organizational Structures

Functional

Divisional

Open Organizational Structures

Matrix

Flat

Connected Business Frameworks

Nadler-Tushman Congruence Model

McKinsey’s Seven Degrees of Freedom

Organizational Structure Case Studies

OpenAI Organizational Structure

Airbnb Organizational Structure

Amazon Organizational Structure

Apple Organizational Structure

Coca-Cola Organizational Structure

Costco Organizational Structure

Facebook Organizational Structure

Goldman Sachs’ Organizational Structure

Google Organizational Structure

McDonald’s Organizational Structure

McKinsey Organizational Structure

Microsoft Organizational Structure

Nestlé Organizational Structure

Patagonia Organizational Structure

Samsung Organizational Structure

Starbucks Organizational Structure

Tesla Organizational Structure

Toyota Organizational Structure

Walmart Organizational Structure

Main Free Guides: