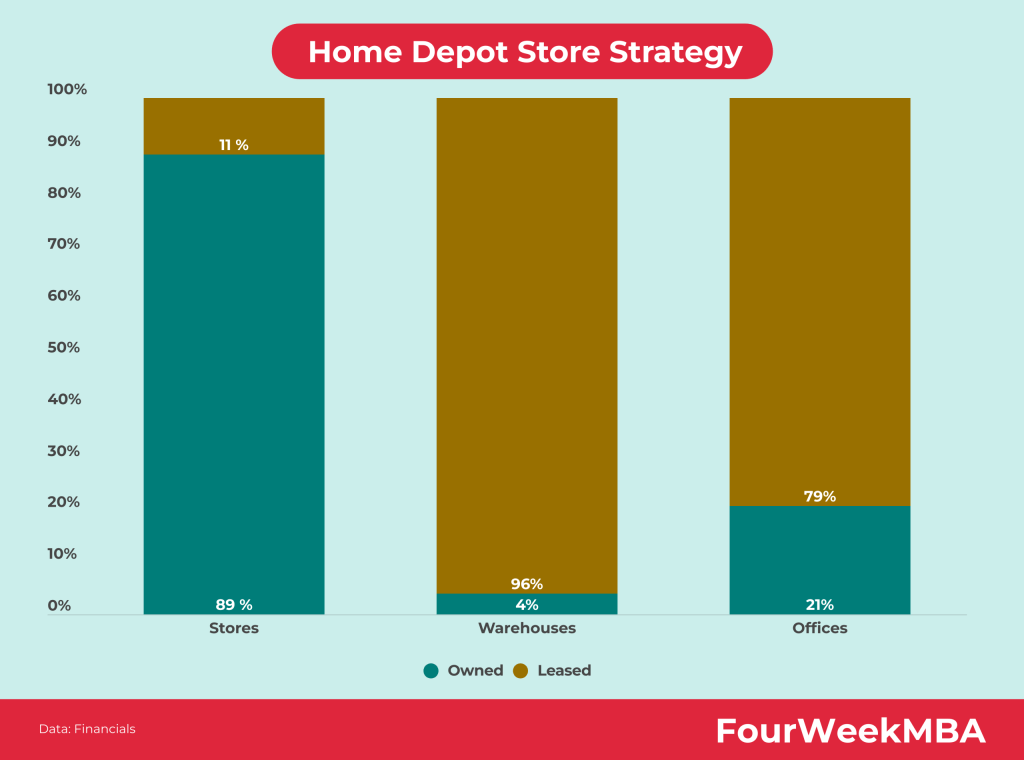

- For Stores, 89% are owned, and 11% are leased.

- For Warehouses, only 4% are owned, while 96% are leased.

- For Offices, 21% are owned, and 79% are leased.

| Store Strategy | Description | Example | Implications | Integration |

|---|---|---|---|---|

| Big-Box Retail Stores | Home Depot operates a chain of big-box retail stores that offer a wide range of home improvement products and services. These stores serve as the primary distribution channel for home improvement and construction materials. | Home Depot’s retail stores are large, warehouse-style outlets that stock everything from lumber and building materials to power tools and home décor. Each store typically covers a significant square footage. | – Provides customers with a vast selection of home improvement products. – Offers a tactile shopping experience for customers to see and touch products. – Requires substantial physical space and inventory management. | Home Depot’s big-box stores are at the center of its store strategy, serving as the primary destinations for customers seeking home improvement products and professional contractors sourcing materials. |

| Pro Desk for Contractors | Home Depot has designated Pro Desks within its stores to cater specifically to professional contractors and builders. These specialized service counters provide dedicated support to contractors, including bulk pricing and order management. | Pro Desk associates at Home Depot assist contractors with large orders, provide bulk pricing discounts, and manage orders for job sites. They also offer expert product advice and support. | – Attracts professional contractors and promotes bulk purchases. – Offers tailored services to meet the unique needs of contractors. – Enhances relationships with professional customers. | Pro Desk services are integrated into Home Depot’s big-box stores, creating a specialized area where professional contractors can access dedicated support and streamline their purchasing processes. |

| Tool Rental Services | Home Depot stores often include tool rental centers where customers can rent equipment and tools for various home improvement projects. This service provides cost-effective access to specialized tools. | Home Depot’s tool rental centers offer a variety of equipment, from power tools to large machinery, available for rent by the hour, day, or week. Customers can complete projects without the expense of purchasing tools. | – Provides a cost-effective solution for customers who need specialized tools. – Attracts DIYers and professionals seeking temporary access to equipment. – Requires maintenance and equipment management. | Tool rental services are integrated into Home Depot stores, enhancing the customer experience by offering a convenient option for customers to access tools and equipment for their projects. |

| Garden Centers | Many Home Depot stores have garden centers that offer a wide selection of plants, gardening supplies, and outdoor living products. These centers cater to customers interested in landscaping and gardening. | Home Depot’s garden centers provide a variety of plants, flowers, gardening tools, and outdoor furniture. Customers can find everything they need for landscaping, gardening, and outdoor projects in one place. | – Attracts customers interested in outdoor and gardening projects. – Enhances the selection of products available in stores. – Requires knowledgeable staff to assist with gardening-related questions. | Garden centers are integrated into Home Depot stores, offering a comprehensive shopping experience for customers interested in home improvement projects that involve landscaping and outdoor spaces. |

| Online and In-Store Integration | Home Depot’s store strategy is complemented by its online presence. Customers can shop online and choose to have products delivered or pick them up in-store. This omnichannel approach provides flexibility and convenience. | Customers can browse Home Depot’s website, place orders online, and select in-store pickup or delivery options. The integration of online and in-store shopping allows customers to choose the most convenient way to shop. | – Provides customers with flexibility in how they shop and receive products. – Allows for a seamless shopping experience between physical stores and the online platform. – Requires robust inventory management and order fulfillment processes. | Home Depot’s online platform is integrated with its physical stores, creating a unified shopping experience that caters to various customer preferences and needs. |

Stores:

- Owned (89%): Home Depot owns approximately 89% of its store properties. This ownership strategy signifies that the company directly holds the titles to a significant portion of its retail locations. Owning stores allows Home Depot to have greater control over the physical spaces, tailor them to its brand image, and potentially benefit from property value appreciation over time.

- Leased (11%): The remaining 11% of store properties are leased. Leasing provides Home Depot with flexibility in entering new markets or testing different locations without the upfront costs and responsibilities associated with ownership.

Warehouses:

- Owned (4%): The ownership of only 4% of warehouses indicates that Home Depot directly holds a small fraction of its warehouse facilities. Owned warehouses might be strategically situated or customized to suit specific operational needs.

- Leased (96%): The vast majority, 96%, of warehouse properties are leased. Leasing warehouses allows Home Depot to efficiently manage its distribution and inventory storage while avoiding the capital-intensive nature of owning large-scale storage facilities.

Offices:

- Owned (21%): Home Depot owns 21% of its office spaces. This ownership percentage suggests that the company has invested in having a stake in a portion of its office properties. Owned offices can provide stability and the potential for long-term asset appreciation.

- Leased (79%): Leasing constitutes 79% of Home Depot’s office properties. Leasing office spaces offers flexibility to adapt to changing business needs, accommodate workforce dynamics, and optimize location strategies.

Benefits of Ownership:

- Ownership grants Home Depot full control over property usage, modifications, and branding.

- Potential for property value appreciation can contribute to the company’s assets and financial strength.

- Owned properties can be used as collateral for financing and other business initiatives.

Benefits of Leasing:

- Leased properties allow Home Depot to expand into new markets or test locations without a significant upfront investment.

- Leasing provides flexibility to adapt to market changes and tailor space to evolving business needs.

- The responsibility for property maintenance and management often falls to landlords in leased spaces.

Considerations for Leasing:

- Leasing aligns well with a strategy of market expansion or testing new locations before committing to ownership.

- Flexibility in space utilization and a focus on core business operations are benefits of leasing.

Considerations for Ownership:

- Ownership may be preferred for stable markets or locations with long-term potential for property value appreciation.

- Strategic ownership of certain properties can enhance Home Depot’s brand identity and market presence.

Related Visual Stories