Amazon generated over half a trillion dollars in revenue in 2023, of which $231.87B from online stores, over $140.05B from third-party seller services, $90.76B from AWS, $46.9B from advertising, $40.21B from subscription services, $20.03B billion in physical stores, and $4.96B from other sources.

| Amazon Revenue Breakdown | Online stores | Physical stores | Third-party seller services | Subscription services | AWS | Advertising | Other |

| 2023 | $231.87B | $20.03B | $140.05B | $40.21B | $90.76B | $46.9B | $4.96B |

The interesting take about Amazon, which many are not aware of, is the fact that its core business (the e-commerce platform) is also, and still, unprofitable.

And the picture is even more impressive if we look at Amazon’s profitability with AWS!

Amazon was not profitable once AWS was removed in 2022.

In fact, Amazon, without AWS, generated $10.6 billion in operating losses.

While Amazon, without AWS, generated $12.2. billion operating income.

It’s easy here to dismiss Amazon and say, “wow, after decades in business, the company is not yet profitable.”

But wait for a second.

Before you dismiss it, there are a few considerations to make.

Bits and atoms

First, Amazon isn’t just an e-commerce company. Amazon is about inventory and fulfillment as much as it’s about e-commerce.

That’s the nature of its flywheel!

Inventory and fulfillment are very intensive in terms of capital requirements, and yet they are critical for enabling customer experience.

And the good news? They give the company much stronger moats.

Over time, anyone might be able to replicate Amazon’s e-commerce.

But a combination of e-commerce, inventory, and last-mile delivery?

Extremely hard to replicate!

Last-mile and transferable network effects

When you look at business models which rely on network effects, those are usually very hard to build.

But when they do kick-off, they might make a tech company valuable for years.

There is another critical point about it: transferable network effects.

Building, maintaining, and speeding up network effects is extremely hard.

Do you know what’s harder? Building liquid network effects.

In short, a liquid network effect is when a platform business has built such an infrastructure that there is plenty of supply and demand to rely on, and those sustain themselves in a sort of smart dynamic market.

When that happens, a company that has empowered such liquid networks can go on and try to transfer them across a new industry.

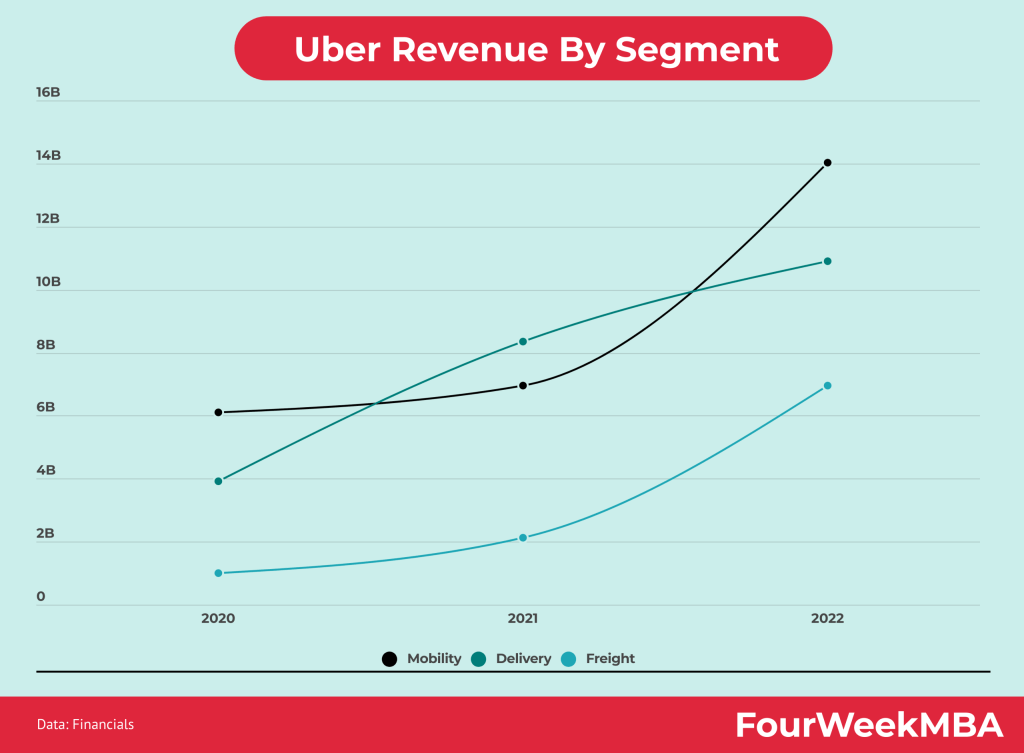

One example of this is how Uber, starting from ride-sharing, first expanded this market to become a multi-billion dollar one.

Then it managed to expand into adjacent segments like delivery and freight.

When you have transferable network effects, you don’t think about a single industry but start thinking about the entire industry, which can be unified under a single paradigm.

For instance, you don’t want to call Uber a ride-sharing, delivery, or freight company today.

Instead, you want to call it a Last-Mile Platform!

A last-mile platform can tackle any industry which relies on the last-mile problem, which states that the most challenging part of a delivery network is in the last mile (or, if you wish, in the last steps) from the company to the customer.

These last steps in the networks, indeed, are a trillion-dollar issue.

These last steps fall outside the network, making it fragmented, unreliable, and expensive.

Thus, when you re-frame the kind of problem a company like Uber and perhaps Amazon is trying to solve, you understand the real potential value of the network!

In short, the sort of network effects that might make you able to launch a whole new business much more quickly by simply leveraging on the existing tech platform!

While figuring out how to unify the networks and make them less and less fragmented.

If you can figure out that problem, you can transfer it across many industries, thus, redefine them!

Built for scale!

When we look at Amazon’s e-commerce platform, it’s critical to consider that since the onset, it has been built for scale and reach.

In short, the e-commerce platform aims to enable as many customers as possible via convenience, variety, and service.

That’s it!

Amazon might make money from it in the future, but it might well be that in 20 years, the e-commerce platform will still be primarily run for scale and reach through convenience, variety, and service.

And it’s worth remembering that thanks to this strategy, Amazon was propelled into “Walmart Status!”

In 2022, Amazon closed its divide in terms of total revenue, as it generated over $513 billion in revenue, compared to over $572 billion in revenue from Walmart.

It took Walmart sixty years to get there, while Amazon took less than thirty years…

The digital ads empire

Now take the case of the Amazon e-commerce platform and Amazon Ads.

And to put things in context, Amazon Ads were larger than YouTube Ads in 2022.

With a core difference, Amazon’s ads segment is just one of the many moving parts for the company!

And we can easily guess that the ads segment might be highly profitable and scalable.

So, if Amazon scaled this to a hundred billion per year business, would e-commerce finally become profitable due to the ads platform?

The AWS rocket ship

In the meantime, Amazon AWS keeps growing at a staggering rate.

Amazon AWS (cloud) is the most successful business segment within Amazon, and it generated over $80 billion in revenues in 2022 and almost $23 billion in operating profit. Compared to over $62 billion in revenues in 2021 and $18.5 billion in net profits.

Of course, as competition in the cloud industry intensifies, this might slow down revenue growth and profitability.

However, it’s worth pointing out that now only is Amazon AWS a tech giant for its own sake, but also how instrumental it will be for the current AI revolution.

Indeed, AI models that rely on massive computational power through AI supercomputers need an infrastructure like AWS to run in the first place.

Take the case of how Stability AI has pre-trained Stable Diffusion on top of AWS!

Thus, AWS will be a key player in the AI race!

Key facts about Amazon

| Key Facts | |

| Founder | Jeff Bezos |

| Year & Place Founded | July 5, 1994, Bellevue, WA |

| Year of IPO | 5/15/1997 |

| IPO Price | $18.00 |

| Total Revenues at IPO | $15.75 million |

| Total Revenues in 2021 | $469.8B |

| Amazon Employees | 1,608,000 full-time and part-time employees |

| Revenues per Employee | $292,177.86 |

Amazon revenue model evolution

| Amazon AWS | $62 |

| Microsoft Intelligent Cloud | $60 |

| Google Cloud | $19.20 |

Key Highlights

- Diverse Revenue Streams: Amazon generated over half a trillion dollars in revenue in 2022. The revenue breakdown includes online stores ($220B), third-party seller services ($117.71B), AWS ($80B), advertising ($37.74B), subscription services ($35.22B), physical stores ($18.96B), and other sources ($4.25B).

- Unprofitable Core Business: Despite its massive revenue, Amazon’s core e-commerce business is still unprofitable. The profitability is significantly influenced by the costs associated with inventory, fulfillment, and last-mile delivery.

- AWS Profitability: Amazon Web Services (AWS) is the most profitable segment, generating almost $23 billion in operating profit in 2022. AWS’s profitability has been a major contributor to Amazon’s overall financial success.

- Operating Profit Segments: Amazon is divided into three operating profit segments: North America, International, and AWS. AWS is profitable, while the other segments operate at negative operating losses. Without AWS, Amazon generated significant operating losses.

- Transferable Network Effects: Amazon’s success is attributed to its ability to create transferable network effects. This means that the infrastructure and networks built for one industry (like e-commerce) can be leveraged to expand into other industries (like last-mile delivery and logistics), leading to business growth.

- Last-Mile Platform: Amazon’s network effects allow it to be considered a “Last-Mile Platform,” capable of addressing challenges related to the final stages of delivery across various industries.

- Built for Scale: Amazon’s e-commerce platform is designed for scale and reach, aiming to provide convenience, variety, and service to as many customers as possible. This strategic focus has propelled Amazon to become a major player in the industry.

- Closing Gap with Walmart: Amazon’s revenue has closed the gap with Walmart’s revenue. In 2022, Amazon generated over $513 billion in revenue compared to Walmart’s revenue of over $572 billion. Amazon achieved this milestone in less time than it took Walmart.

- Amazon Ads: Amazon Ads is a significant revenue generator and was even larger than YouTube Ads in 2022. The potential profitability and scalability of the ads segment could contribute to making the overall e-commerce business profitable.

- AWS Growth: Amazon AWS continues to experience rapid growth, generating over $80 billion in revenue and almost $23 billion in operating profit in 2022. AWS’s role in the AI revolution and computational power is crucial.

- Key Facts: Amazon was founded by Jeff Bezos on July 5, 1994, and went public on May 15, 1997, at a price of $18 per share. It started with $15.75 million in total revenues at IPO and has grown to generate $469.8 billion in revenue in 2021, with a large employee base and revenues per employee.

Related to Amazon Business Model

Read next:

- Amazon Business Model

- What Is the Receivables Turnover Ratio? How Amazon Receivables Management Helps Its Explosive Growth

- Amazon Case Study: Why from Product to Subscription You Need to “Swallow the Fish”

- What Is Cash Conversion Cycle? Amazon Cash Machine Business Model Explained

- Why Is AWS so Important for Amazon Future Business Growth?

- Amazon Flywheel: Amazon Virtuous Cycle In A Nutshell

- Amazon Value Proposition In A Nutshell

- Why Amazon Is Doubling Down On AWS

- The Economics Of The Amazon Seller Business In A Nutshell

- How Much Is Amazon Advertising Business Worth?

- What Is the Cost per First Stream Metric? Amazon Prime Video Revenue Model Explained

- Jeff Bezos Teaches You When Judgment Is Better Than Math And Data

- Alibaba vs. Amazon Compared in a Single Infographic

- Amazon Mission Statement and Vision Statement In A Nutshell