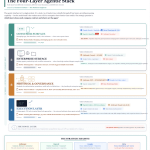

The enterprise AI platform war has a new battleground: the agentic orchestration layer.

Every major player is making their move:

- Salesforce rebranded its entire platform around Agentforce 360

- Microsoft launched Agent 365

- SAP deployed Joule

- ServiceNow rolled out AI Agents

- Adobe unveiled AI Foundry

- Workday launched Illuminate

This isn’t feature competition. It’s platform war for the recommendation surface of enterprise work.

The Platform War Logic

From the M&A Playbook: whoever owns the distribution surface controls the margin.

In consumer AI, ChatGPT’s 68% market share and 79% returning user rate created a distribution moat. The same logic now applies to enterprise.

The “recommendation surface” in enterprise = which agent mediates your workflows.

The Lock-In Paradox

Here’s the tension every platform faces:

“Every hyperscaler says they want interoperability while building for lock-in. An agent that moves fluidly across all vendor systems commoditizes them all.”

Salesforce wants agents that orchestrate within Data 360. Microsoft wants agents that live in Fabric. The prize is becoming the orchestration layer—not one agent among many.

The New Pricing Battleground

Salesforce’s AELA (Agentic Enterprise License Agreement) signals a shift: flat fee, shared risk, “all you can eat” with Agentforce.

This is a Goldilocks Zone play—avoiding the “too hot” extraction trap by creating pricing flexibility. Expect Microsoft, SAP, and others to follow.

Who Wins?

The platform war framework predicts:

- Surface equals power. The interface owner captures value regardless of underlying capability.

- Network effects compound. Every workflow automated generates data that improves orchestration.

- Winner-take-most is structural. Five equal players isn’t sustainable.

By end of 2026, expect 2-3 dominant agentic platforms—and everyone else scrambling for integration partnerships.

Framework: The M&A Playbook of the AI Economy | The Business Engineer