Tesla is vertically integrated. The company runs and operates Tesla’s plants. Cars are manufactured at the Gigafactory which also produces battery packs and stationary storage systems for its electric vehicles. These are sold via direct channels (Tesla online store and the Tesla physical stores). In 2023, Tesla generated $96.77 billion in revenues. Automotive sales generated $78.5 billion (81% of the total revenues); services/other generated $8.32 billion, and energy generation and storage generated about $6.03 billion in revenues.

| Revenues breakdown | 2023 | % |

| Automotive sales | $78.5B | 81% |

| Automotive regulatory credits | $1.79B | 1.85% |

| Automotive leasing | $1.64B | 3.05% |

| Services and other | $8.32B | 8.6% |

| Energy generation and storage segment revenue | $6.03B | 6.24% |

| Total Revenues | $96.77B |

| Key Facts | |

| Founders |

Elon Musk, Martin Eberhard, JB Straubel, Marc Tarpenning, Ian Wright

|

| Year Founded | July 1, 2003, San Carlos, CA |

| Year of IPO | June 29, 2010 |

| IPO Price | $17.00 |

| Total Revenues at IPO |

$93.35 million, as of Nine Months Ended

September 30, 2009, prior to the IPO |

| Elon Musk becomes CEO | 2008 |

| Total Revenues in 2023 | $96.77 Billion |

| Employees | 140,473 full-time subsidiaries employees worldwide by 2023 |

| Revenues per Employee | $688,908 |

| Who owns Tesla? | Elon Musk is the primary individual shareholder, with 20.6% of the company’s shares |

Tesla business model quick breakdown

We describe the Tesla business model via the VTDF framework developed by FourWeekMBA.

| Tesla Business Model | Description |

| Value Model: Transition to renewable energy. |

Tesla’s mission is “to accelerate the world’s transition to sustainable energy.” The company does that through mobility products (cars for now) powered by electric engines. And by building the infrastructure to produce energy from renewable sources (solar primarily).

|

| Technological Model: Multi-sided network effects. Mass manufacturing |

As of now, Tesla is a car company, but it’s also and primarily a software company. When Tesla releases new software updates, these consistently improve its cars (from suspensions to self-driving and more). When it comes to certain features, like self-driving, Tesla enjoys network effects, where the more the software is used to record mileage, the better it gets. And the more Teslas are on the road, the more it creates the infrastructure where these cars understand each other. And the more energy stations are available, the more EVs become convenient vs. gas-powered vehicles. Also, Tesla is one of the few companies that managed to build a sold car business at scale, in the last century.

|

| Distribution Model: Direct Distribution. Leasing arm. |

Tesla leverages its online and physical stores. Since the start, the company opted for a direct approach, bypassing car dealers. In addition, Tesla built, over the years, stores that mimicked Apple successfully. Another important element for distribution over the years will be the company’s leasing arm. Suppose Tesla can make leasing convenient for its customers. In that case, it might be able to exponentially grow its revenues (just like the iPhone was subsidized by mobile carriers, a Tesla should be subsidized through convenient leasing agreements to make it scale at the mass level in the US).

|

| Financial Model: automotive regulatory credits, leasing, generating margins at mass production for both cars and energy storage. |

Tesla’s regulatory credits will exponentially grow as the company scales its operations. In fact, those credits are given to Tesla because it produces 100% electric vehicles. Thus, as the production scales, Tesla will get more credits at no additional cost or effort. In addition, as Tesla scales, it might be able to build its leasing arm, which might work as the real cash cow, on the one hand, and also the driver of the company’s car sales in the future (a Tesla might be too expensive for many, without a lease). In addition, Tesla isn’t just a car company; it’s transitioning to become a major energy producer with its superchargers and electric infrastructure. From energy production to distribution, Tesla might become the Exxon of the future!

|

Tesla’s business model today

To understand where is Tesla today, in terms of business model evolution, see the graphic below.

Indeed, Tesla has gone through various phases in its history, now.

In the first phase, the company had to show the viability of its technology through a very niche product, which turned out to be the Tesla Roadster.

As the Roadster proved EVs could be built, it was a matter of enabling that technology on a larger scale.

It took Tesla fifteen years to reach that scale with its Model 3, which is the car intended for the mass market.

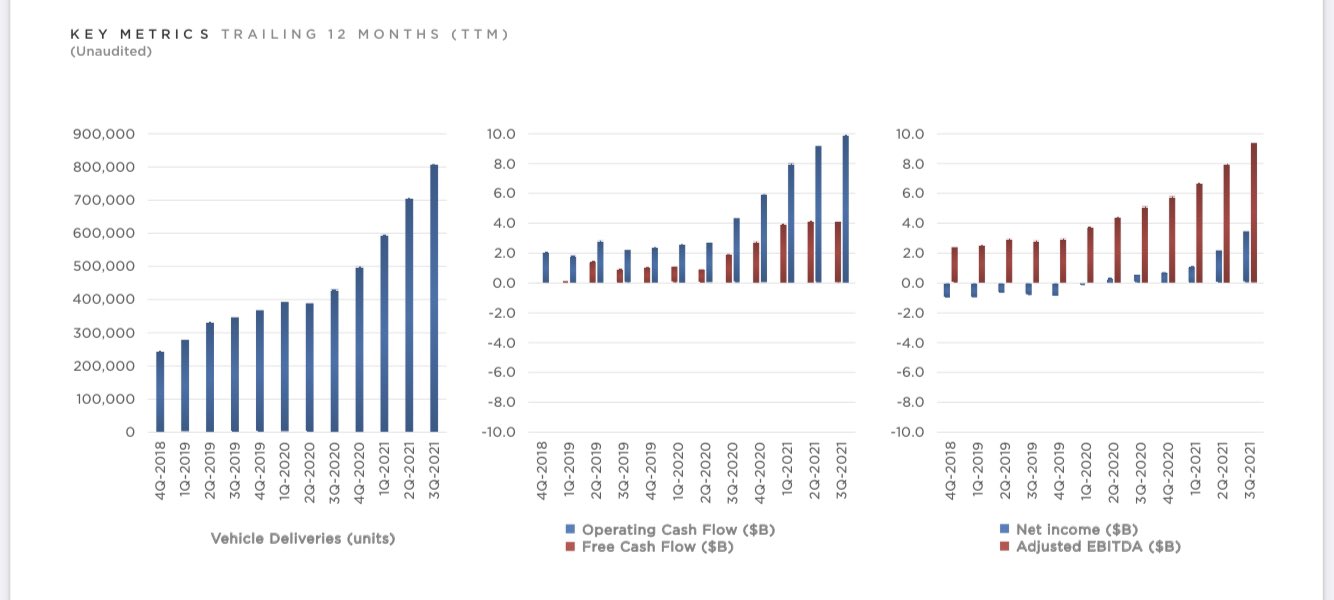

For all its life, Tesla has been recording net losses and burning cash.

And yet, in a single year, by 2021, it generated so many profits to cover most of the losses recorded in the previous decade.

This is what it means to achieve scale. This is where Tesla is today in terms of scale!

Indeed, when Tesla launched, it had to first showcase that it would be possible to build an EV that would be able to combine performance and aesthetics.

Let me recap the various stages of the evolution of Tesla as it scaled.

Indeed, when looking at any company, it’s critical to understand that it follows a transitional business model, each of which, will serve the company well throughout a specific stage of Scale.

At a certain scale, you need a specific product enhanced by technology, which will help you serve a market, through distribution.

As the company gets ready for further stages that old business model transitions to a new one, where the core building blocks also change.

Let me explain:

Phase 1: Tesla Roadster and microniching

In the first stage of growth, Tesla had the first to build a viable EV.

Thus, initially, the problem was more about developing the proper technology and an EV in the first place, which would be comparable to a gas-based vehicle.

Tesla did that by targeting a narrow sub-segment of the sports car industry.

A few hundred people were interested in a sports car that would combine performance and aesthetics, while also avoiding pollution.

At that stage, Tesla didn’t need huge demand, but only a few hundred interested people.

And it didn’t need large manufacturing facilities, but only the proper technology to build a viable EV.

Things changed as Tesla accomplished the task of proving it was able to build a sports car.

This is the moment where Tesla’s business model would be successful by simply targeting a small number of innovators.

This stage was between 2006-2012.

Phase 2: Launching the Model S to target the early adopter

As Tesla managed to achieve the first stage of growth, its business model transitioned, by targeting a wider segment of the market.

To do so, the company had to figure out how to scale manufacturing, while providing a larger number of vehicles, and a product, the Model S, targeting the higher-end of the car market.

Still there, Tesla didn’t need millions of customers, but rather a few thousand.

And this opened up new options to scale for the company.

At this stage, scaling manufacturing was part of the puzzle. Most of it was to test the technology on a much wider number of vehicles, to see if it would be viable at such a scale.

All while expanding demand.

This stage was between 2012-2018.

Launching the Model 3 for mass adoption.

In the third stage of growth (which is still ongoing today), Tesla had to target the mass market.

In this context, scaling up manufacturing has become critical.

Indeed, if you asked Elon Musk where he focused most of his attention between 2018-2022, he might say the modeling/engineering of manufacturing facilities that would be able to scale production.

This was an incredible fit, which only Tesla managed to achieve in the last decades.

As Tesla went through these stages of its business model, the company has gone through various near-death experiences.

In fact, going from one stage of Scale to the next is not easy as it requires a paradigm shift.

Tesla founding story

The electric carmaker company is owned by entrepreneur/visionary Elon Musk. Tesla was founded by Martin Eberhard and Marc Tarpenning in July 2003. Elon Musk entered Tesla in 2004, first as an investor and chairman, then he took the role of CEO which he still holds today.

After many delays to the first production of the Tesla Roadster prototype (the first version of the Tesla, which was both a way to validate the market and to generate revenues to be invested in the production of new Tesla models), Martin Eberhard would eventually be ousted, and Musk would, later on, by 2008, become CEO of the company.

It all officially started in July 2003, when the company got incorporated as Tesla Motors, Inc. Two men, Eberhard and Tarpenning, got appointed respectively CEO and CFO.

They had known each other from their time at NuvoMedia, the company they had led to the development of the Rocket eBook. The first e-book was launched in 1996 when the commercial Internet was still at the embryonic stage (for some context, the Amazon Kindle would be launched in 2007).

Yet, even though Eberhard had founded and led NuvoMedia to a successful acquisition, which in the year 2000, was purchased for $187 million, by another media company, Eberhard was all but rich.

In fact, over the years his shares in the company had been diluted to the point, that, Eberhard’s exit from the sale only had not made him rich, but as he was divorcing his wife, most of that wealth went to her, and Eberhard had to start all over again.

Yet, along his journey Eberhard, had met Elon Musk, which, by 2003, was deep into his new venture: SpaceX.

Musk’s first ventures

Elon Musk had successfully exited the PayPal sale, by making $180 on a $1.5 billion acquisition in 2002. Yet, while SpaceX had been founded in 2002, Elon Musk had started to look into it, a couple of years before.

Musk was not new to entrepreneurship and the rollercoasters this “profession” was about. In fact, a few years back to PayPal, in 1995, together with his brother, Musk had founded Zip2.

The company built maps and business directories, which were very useful applications for media websites. Eventually, they sold the company to Compaq, for over $300 million, which made Elon Musk more than $20 million to start his next company. Zip2 would become a component of AltaVista, the search engine owned by Compaq.

With the new cash infusion, Musk started his next company, called X.com. Musk’s vision was to transform X.com into a financial behemoth, through the Internet. While his vision was unbounded, he also pushed his team to execute fast.

Yet, X.com had been founded in late 1999, when the commercial Internet was still young, and revolutionizing the financial system was not as simple as it seemed.

X.com’s team randomly met the team of Confinity (for a period they were neighbors sharing the same office building).

Another startup, created in late 1998, similarly to X.com was trying to build an Internet financial company. Yet, while X.com had an unbounded vision, Confinity, which had been founded by Pether Thiel, and Max Levchin, wanted to give people the ability to pay online, by beaming their money through a device, called PalmPilot.

For some context, in the late 1990s, the Palm Pilot was a successful device, especially in California, which is where Confinity was operating. Yet, the initial business plan of the company didn’t seem to work in the real world.

In fact, the beaming technology never took off as they had envisioned.

Instead, by late 1999, one thing was clear, a “side feature” became the killer commercial application for both companies. That was the ability to pay by using an email.

This, in fact, would become the primary feature for both X.com and Confinity, and both had stumbled upon it, as it got very popular on a platform: eBay.

While those two companies were very different, they had completely different visions, and leadership, in a strange turn of events, the companies that once were neighborhoods, eventually merged.

The new company was called PayPal, after Confinity’s email payment feature, which was already well known thourhg eBay. Thus, the company took the name of the side-feature, which unexpectedly became the commercial killer application.

Yet, by early 2000, the newly created PayPal, was all but safe.

In fact, the various near-death experiences in a year time frame turned PayPal into a drama machine. In the meantime, this drama machine had taken out various CEOs, until Elon Musk became – unwillingly – CEO of the company.

Yet, once CEO he pushed the company with his unrelenting management style, which pushed people beyond their limits. The management style of Musk, coupled with a complete divergence in vision between Musk and the other co-founders (in particular Thiel, Levchin, and Sacks) led to a final conflict.

Indeed, in 2000, Musk would be ousted as CEO, with a coup organized by PayPal’s other co-founders, Peter Thiel, Max Levchin, and David Sacks. As Musk was on his honeymoon, he was flying and he could not fight that back.

Musk was out from PayPal, and now he had time to think about what would come next!

SpaceX

As Musk got time to think about his next ventures. He had looked into something that he had been passionate about since childhood: space.

First, he tried to get involved by helping NASA get more funds and interest, in space exploration. He thought that was the main issue. Space exploration, a hot topic, during the 1960s-70s, had stalled, in the last decades.

Yet Musk realized it was not a matter of funding. The whole innovation system, related to space, was non-existent, so he needed to get involved.

As he got involved, he started to build SpaceX, from scratch. Indeed, initially, he had looked into various ways, to outsource parts of the rockets. But over time, SpaceX would have a different approach. SpaceX started to build all the components that would make up the rocket, in-house.

And yet, let’s remember, when SpaceX’s journey, crosses that of Tesla, we’re in 2003, when all SpaceX had was a prototype rocket on a computer. It would still take a few years for SpaceX to successfully perform its first launch.

In fact, on September 28, 2008, SpaceX completed the Falcon 1 launch successfully!

In this context, Tesla entered the picture.

Back to Tesla

Musk had always been passionate about cars. In the footage, back in 1999, Musk was among the buyers of a rare supercar, which he showed off to the camera:

EVs were in the air. Indeed, in 1999, GM had launched its EV1, which turned out as a complete flop:

But it was also about performance and coolness.

In fact, most of the electric vehicles that were in production were bulky, ugly, and ineffective.

Tesla was set to change all that.

Telsa’s Roadster

Tesla’s initial plan was to manufacture a sports car that would be compelling to a very niche audience. Indeed, the target for the Tesla Roadster was to showcase the technology to a bunch of innovators, that liked the idea of an electric vehicle, which performance, could compete with other sports cars.

However, as Eberhard started to roll out Tesla’s business model (Musk had endowed Tesla with a few million, in 2004, to start the production of the Roadster) it became clear that building a performance electric car was not an easy fit.

While Eberhard had targeted the right audience (wealthy Californians, who would use the Tesla Roadster as a status quo), he had miscalculated the execution strategy.

Indeed, Eberhard thought Tesla could be built by outsourcing most of its parts (just like he had done years back with manufacturing the NuvoMedia ebook device). Yet, this turned out to be not the case.

Several challenges came up, right on:

- Batteries cathed fire.

- Components were way more expensive than they thought.

- Large suppliers didn’t want to deal with Tesla, at the time a small startup, when the legal liability of batteries was much bigger than the potential payoff for the supplier.

All the above didn’t help.

And Eberhard felt more and more pressure, as time goes by, and the Tesla Roadster is far from manufacturing, and it was way more expensive than the price point Musk had promised.

In this period, a person which played a key role at Tesla, and would be the main point of contact for Musk was JB Straubel. An engineer at the core, he was interested in battery technology.

He had worked in 1993 for Rosen Motors, and, just like Ford, in the late 1800s, Straubel was a racer.

Indeed, for him racing electric cars was a way to showcase their torque (with respect to gas-powered vehicles, electric cars produce an instant torque, which made the start of an EV more similar to a rocket launch than a car start).

Straubel’s ability to tinker with the electric engine would prove critical. In fact, one of the major issues with battery packs was that they caught fire.

Strauber invented a way to prevent batteries to catch fire, by enabling these cells to dissipate their energy. This was a major improvement.

While Eberhard was trying to progress with the Roadster, Musk was putting growing pressure on him. He wanted Tesla to execute faster, and he came up with continuous changes to the car.

Musk, therefore, had very close ties to the company. Indeed, when he had first invested in Tesla, of the total $6.5 million round, Musk had invested $6.35 million of his own money, while Eberhard had invested $75K (as a “skin in the game deposit”).

While the relationship between Musk and Eberhard, initially was a good one.

Over time, it deteriorated. And things only got worse, when Musk introduced a team within Tesla to audit its finance and see what was the real cost of producing the Roadster, at that moment.

From the analysis, it came up that expenses were out of control, and that the challenges to producing the Roadster were none near!

This triggered Musk, who added pressure on Eberhard and convinced him to start thinking about resigning as CEO and focus on the product instead.

While they both had agreed, eventually things precipitated, and the relationship between Musk and Eberhard quickly deteriorated.

To the point that Eberhard left Tesla, by signing a non-disparagement agreement, and after a quest to find Tesla’s new CEO, eventually, Musk appointed himself! It was 2008, and one of the greatest financial turmoils was to hit the US.

The Secret Tesla Master Plan

By 2006, Musk would lay out the foundation for Tesla’s plan for the next decade. It was a four points master plan, structured as below:

- Build sports car

- Use that money to build an affordable car

- Use that money to build an even more affordable car

- While doing above, also provide zero emission electric power generation options

These four points would take a decade to be executed. Musk showed how, even when it comes to an unbounded vision, like his, most of it is still about execution.

In the meantime, Musk had become the CEO of Tesla, which had also turned into a draining endeavor, consuming a lot of his time. And yet, as the 2008 financial crisis hit, Tesla managed to survive it, also thanks to a partnership with Daimler, which kept the company afloat.

As Wired explained back in 2009:

The deal provides Daimler with batteries and the know-how needed to bring an electric car to market “at the highest possible speed,” company officials said. In exchange, Tesla gets a big pile of cash and, perhaps more importantly, the parts and engineering expertise it needs to build the Model S sedan.

This deal would be critical for Tesla to get additional oxygen while having a strategic partner, and going toward the IPO.

In fact, Tesla would IPO the year after, at $17 per share, valuing the company at about $2 billion.

Tesla borrowing Apple’s retail strategy

As Tesla started to roll out its business plan, back in 2003, the company chose to keep control over the sales experience.

This choice was not an easy one. Indeed, the Tesla executive team liked the idea to go direct to consumers. But in the auto industry that was not an easy fit.

In fact, most auto companies sold through car dealers and franchises. Those franchises represented a huge, and powerful industry, which made most of its money, not necessarily on the sale of the vehicle, but rather on servicing the vehicle over time.

Yet, since the onset, Tesla had a feeling that going through car dealers wasn’t the right pick for it. And it started to build its retail capabilities.

In that respect, Tesla borrowed Apple’s retail strategy. For that matter, George Blankenship, a key player in the retail strategy of both GAP and Apple, played a key role in launching the Tesla store operations.

In 2008, Tesla opened up its first store, in LA, on Santa Monica Blvd.:

The store would play a key role in both educating people about the Tesla brand, but also, later on, developing the service side of the business.

By controlling the customer experience, Tesla could, over time amortize the cost of the stores and build a valuable/differentiated brand. Even though Tesla’s cars were expensive.

Building up stores that sold wasn’t easy either.

By 2013, Tesla sales figures looked bleak, so much so that Musk looked into a potential sale of the company to his friends, Google’s co-founders’ Page and Brin, for $6 billion.

Indeed, after setting up the templates for the stores, Blankenship had left the company. And Tesla’s slowing sales were clear in 2015. McNeill revamped the sales force and trained it to close deals.

Where in the early days the store was only about education, by 2015, it had to become a sales machine, to make Tesla numbers add up!

By 2022, Tesla had hundreds of locations across the US.

To get to its sales numbers though, Tesla had to solve another critical issue,: making batteries for its cars available at scale!

The Gigafactory

As we go through the whole Tesla history, another key ingredient was the Gigafactory.

In fact, as Tesla had successfully launched, and dumped up production of the Roadster first, it had already started to invest in the Model S, which by 2012, had launched.

Yet, the real turning point, for Tesla’s scale would be represented by the Model 3.

Indeed, the Model 3 would have changed it all for Tesla, by expanding its market and by enabling it to “cross the chasm.”

The Roadster proved the viability of the technology to a small niche of the sports car industry, represented by innovators who were more interested in the technology.

The Model S had represented a further step. Moving from innovators to early adopters. People are interested also in the technology, but also in the performance, aesthetics, and in part, pricing.

As Tesla moved ahead, the Model 3, became the turning point. The car to move from early adopters to the early majority.

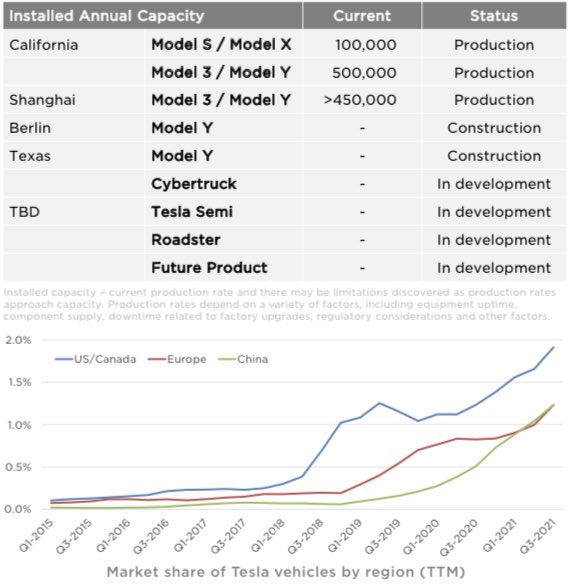

In fact, as the company highlighted “Tesla’s mission is to accelerate the world’s transition to sustainable energy through increasingly affordable electric vehicles and energy products. To ramp production to 500,000 cars per year, Tesla alone will require today’s entire worldwide supply of lithium-ion batteries.”

Therefore, where the Roadster was about prototyping, the Model S was about manufacturing, the Model 3 was all about mass manufacturing!

In order for Tesla to achieve mass scale, the Gigafactory played a pivotal role.

As the company explains:

Tesla broke ground on the Gigafactory in June 2014 outside Sparks, Nevada. The name Gigafactory comes from the word ‘Giga,’ the unit of measurement representing “billions.” The Gigafactory is being built in phases so that Tesla can begin manufacturing immediately inside the finished sections and continue to expand thereafter. Already, the current structure has a footprint of more than 1.9 million square feet, which houses approximately 5.3 million square feet of operational space across several floors. Still, the Gigafactory is about 30 percent done. Once complete, Tesla expects the Gigafactory to be the biggest building in the world – and entirely powered by renewable energy sources. Designed to be a net zero energy factory upon completion, the facility will be primarily powered by solar, and installation is already underway.

For Tesla to build its own batteries was another turning point.

Vertically integrating

As Tesla scaled, one thing was clear, Musk sought to control.

Tesla had kicked off its business plan by wanting to outsource almost everything.

Instead, it ended up manufacturing its own batteries, while going direct to consumers with its online and retail stores.

Another piece of the puzzle was lacking: energy production.

In that respect, a company called SolarCity, founded in 2006, would eventually become part of Tesla.

Musk had prompted his cousins, Lyndon Rive, and Peter Rive to start SolarCity.

The idea was to build this into an external arm, able to provide potentially clean energy for Tesla vehicles. In fact, Musk backed the company, while sitting on the boars of SolarCity and Tesla.

Yet, by 2016, the financial outlook for SolarCity looked bleak, and Tesla had to bail out the company by purchasing it for $2.6 billion.

Later on, Musk would be involved in a lawsuit from shareholders around this acquisition.

However as SolarCity looked like a bailout, Musk was able to reframe it as an expansion of Tesla’s mission.

In fact, in 2016, ten years after the Tesla Master Plan, Musk drafted the Master Plan, Part Deux (part two):

- Create a low volume car, which would necessarily be expensive

- Use that money to develop a medium volume car at a lower price

- Use that money to create an affordable, high volume car

And… - Provide solar power. No kidding, this has literally been on our website for 10 years.

As Musk justified at the time:

We can’t do this well if Tesla and SolarCity are different companies, which is why we need to combine and break down the barriers inherent to being separate companies. That they are separate at all, despite similar origins and pursuit of the same overarching goal of sustainable energy, is largely an accident of history. Now that Tesla is ready to scale Powerwall and SolarCity is ready to provide highly differentiated solar, the time has come to bring them together.

While this was a narrative Musk had built around, and to justify the acquisition of SolarCity, by 2021, the energy generating and storage segment (of which SolarCity was part) generated over $2.79 billion in revenues.

Subsidizing Tesla via its leasing arm

When Apple launched the iPhone, it combined hardware, operating system, and a marketplace to enable third-party to develop applications on top of its device.

The iPhone’s success was staggering, not just because it represented a device adopted, at mass, which would build the next consumer platform for decades to come.

Instead, Apple had managed to succeed nonetheless how expensive the iPhone was and is (the latest iPhone is more expensive than most computers out there).

How did Apple manage to succeed in distributing its iPhone?

Steve Jobs made mobile carriers subsidize the iPhone by amortizing its cost through the phone plans! (Apple deal explained here).

Still, as of today, most of the iPhone sales do not come from Apple direct stores. They come from third-party stores, which sell those iPhones via mobile carriers plans.

This is how you make a very expensive product, accessible, at scale.

At the same time, Tesla borrowed this strategy. But rather than enabling the subsidizing of Tesla through third-party, the company is doing it the way it has always done, through in-house leasing.

In fact, back in 2019, Tesla started to rump up its leasing operations of the Model 3 (the car which is supposed to go to the masses!) to enable the amplification of its distribution strategy, by subsidizing the product, and by building its own leasing arm.

In 2021, Tesla generated over $1.64 billion in revenues from its leasing arm (growing 56% year-on-year). And it’s not just about the revenues coming from the leasing arm.

It’s primarily about the additional distribution potential that this leasing arm would add to the company’s customer base (considering that Tesla is experimenting with a $0 down payment in various states in the US).

Tesla to the masses

Back in 2018, to Musk’s admission, Tesla was going through a very tough time again (the third near-death experience), and most expected Tesla to fail.

So much so that Musk was looking into selling Tesla to Apple, for $60 billion!

The deal didn’t land, Tesla kept pushing through executing its plan, and after avoiding the worst period since its inception (short sellers were betting against Tesla since 2015), the opening of the Shangai Gigafactory made things look great again!

The Gigafactory is instrumental to Tesla’s future ability to deliver cars at scale. In 2022, another key milestone was achieved. Tesla opened its Berlin Gigafactory, right in the heart of Europe’s automotive industry!

Master Plan, Part Three: An energy infrastructure platform?

While the challenges ahead for Tesla are still major, from mass production to the ability to deliver its new models, to a fully self-driving car, the ability to automate manufacturing through robotics, and to build its leasing/financing arm.

Yet Tesla seems to be building up what we can define as an energy infrastructure platform.

This platform might go well beyond cars, to embrace transportation, robotics, software, service, and finances.

The bet then is how big is this market in the future.

And to be sure, while this all makes sense in hindsight, Musk’s vision to get there has always been there. The pat was all but linear.

Slowly, then suddenly blowing competition off the water

The journey from the Tesla of the early days, to the Tesla of today, has gone through many near-death experiences, potential sales of the company, several mental breakdowns of Musk and the executive team around him, and many exciting achievements!

And still, in 2018, Tesla’s success was all but granted.

It took about 15 years for the company to build a viable business model at scale.

And while things progressed slowly for a long-time, they eventually and suddenly took off, blowing competition off the water.

It took two decades for Tesla to build the company we know today, and three years (between 2018-2021) from close to bankruptcy, to the trillion-dollar company!

If there is a lesson we can learn is innovation is expensive, unpredictable, first slow, then extremely fast, and only explainable in hindsight.

Who owns Tesla?

As of February 2024, Elon Musk is worth more than $190 billion.

Understanding Tesla’s long-term strategy

While we all know Tesla today, its strategy was shaped already a few years back. Usually, effective strategies get rolled out in years, and only after they become successful do those become obvious.

Yet, when they are getting rolled out they are not obvious at all. So much so, that those rolling out the unconventional strategy, are getting criticized, ostracized, and only in the end idolized.

This is the case of Tesla’s long-term strategy, which is worth analyzing to understand what entry-strategy Tesla employs, and what its long-term strategy looks like.

Targeting a subsegment of the automotive market

Based on the market context, companies, especially startups have to find ways to enter markets, often dominated by other players, and roll out a temporary business model, which is only viable in the short-term, as it helps the company to transition to a more mature business model, to achieve scale.

When Tesla entered the market, it did it via the launch of the Roadster, a sports electric car, so it could start validating the market gradually, by a sub-segment of the automotive industry.

This enabled Tesla to enter with a product priced competitively (Tesla wasn’t able at the time to offer an electric vehicle at a competitive price). As sports cars are higher-priced, that segment of the market was in fit with Tesla’s temporary business model.

At the same time, the sports car segment also had customers open to more innovative products, as long as they would be highly differentiated.

Yet before transitioning to a new business model, the company will need to validate smaller segments of the market by attracting the psychographic which is ready to take on the new technology.

Yet often new technologies require the development of a whole ecosystem. For instance, in the case, of Tesla, it’s not about convincing people that electric cars are “cool” (not only that).

But also, initially, about providing the infrastructure to make the electric vehicle competitive in terms of everything else (availability of charging stations, charging vs. refilling, cost of batteries, time to recharge, and so on).

Only a few years after, in 2012, Tesla would finally start to roll out a business model based on potential mass adoption of its electric cars:

Only in 2012, Tesla would finally launch its Model S, the electrical sedan, intended to be adopted at a mass level. This strategy is still getting rolled out, and it might still take years to get to the level of mass production.

Successful strategies take years to become viable, as in some cases, they require the fit between the technology and the ecosystem it encompasses and the market.

When this happens the company rolling out the business model will reach its full potential in terms of scale.

Back in 2012, Elon Musk explained that well:

“In 2006 our plan was to build an electric sports car followed by an affordable electric sedan, and reduce our dependence on oil…delivering Model S is a key part of that plan and represents Tesla’s transition to a mass-production automaker and the most compelling car company of the 21st century.”

Is Tesla profitable yet?

Tesla turned a profit for the first time in the third quarter of 2019. Indeed the company posted $143 million in net profits. However, annualized the company’s net losses were $862 million.

What’s Tesla’s value proposition?

As highlighted in its financial statements, Tesla offers three core values to its customers:

- Long Range and Recharging Flexibility

- High-Performance Without Compromised Design or Functionality

- Energy Efficiency and Cost of Ownership

Tesla Core Technology

Source: Tesla Financials

Tesla’s core technology moves around three core parts:

- Autopilot & Full Self Driving (FSD).

- Vehicle Software.

- Battery & Power train.

Breaking down Tesla’s business model

For the first time in its history, in January 2020, Tesla passed the $100 billion market capitalization.

By 2022, Tesla passed a trillion-dollar market cap, a 10x growth. For some context, in the same period, a company like Ford had a 60-70 billion dollars market cap.

Tesla sells three main products:

Model 3: for mass adoption

A four-door mid-size sedan with a base price for mass-market appeal produced both in the Fremont Factory and. at the Gigafactory in Shanghai.

Model Y: the SUV

That is a compact sport utility vehicle (“SUV”) built on the Model 3 platform with the capability of seating up to seven adults.

Model S and Model X: the full-size sedan

That is a four-door full-size sedan that features large touchscreens driver interface, Autopilot hardware, over-the-air software updates, and fast charging through our Supercharger network.

Related: What Is a Business Model? Successful Types of Business Models You Need to Know

Elon Musk’s long-term vision for Tesla

Back in 2018, Elon Musk highlighted the long-term vision for Tesla:

Our goal is to become the best manufacturer in the automotive industry, and having cutting edge robotic expertise in-house is at the core of that goal. Our recent acquisitions of advanced automation companies have added to our talent base and are helping us increase Model 3 production rates more effectively. We don’t want to simply replicate what we have built previously while designing additional capacity. We want to continuously push the boundaries of mass manufacturing.

Tesla’s mission can be summarized as:

to accelerate the world’s transition to sustainable energy.

As the company highlights:

Tesla builds not only all-electric vehicles but also infinitely scalable clean energy generation and storage products. Tesla believes the faster the world stops relying on fossil fuels and moves towards a zero-emission future, the better.

Elon Musk is getting ready to share a further Master Plan, for Tesla’s coming decade.

Tesla revenue streams explained

Tesla has four main sources of income:

- Automotive

- Automotive leasing

- Services and other

- Energy generation and storage

Based on Tesla’s financial statements, in 2021 the company almost doubled its revenues while improving substantially its bottom line.

The most important revenue stream is the Automotive sales revenue (which includes revenues related to the sale of new Model S, Model X, and Model 3 vehicles, including access to Supercharger network, internet connectivity, Autopilot, full self-driving, and over-the-air software updates, as well as sales of regulatory credits to other automotive manufacturers) with over $45 billion, followed by automotive leasing with over $1.6 billion and services and other with over £3.8 billion.

And to be sure, this was all but a linear process. As Elon Musk highlighted, Tesla’s success was far from taken for granted. The worst near to death experience was in 2018 when Tesla wasn’t able to hit its production target, in what Musk called a “production hell.”

That funding round completed 6pm on Christmas Eve in 2008. Last hour of last day possible, as investors were leaving town that night & we were 3 days away from bankruptcy. I put in all money I had, didn’t own a house & had to borrow money from friends to pay rent. Difficult time.

Tesla distribution strategy

Tesla is vertically integrated, as its pipeline goes from manufacturing to direct sales of its vehicles.

As highlighted by Tesla “the benefits we receive from distribution ownership enable us to improve the overall customer experience, the speed of product development, and the capital efficiency of our business.”

Even though a vertically integrated network represented a substantial investment in terms of physical assets Tesla can keep control over the experience of its customers. While also being able to retain important feedback throughout the supply chain.

Indeed, in a model where the customer is reached via indirect distribution the company might lose control of the customer experience at the last mile, and the valuable feedback it can gather from the marketplace.

Tesla follows an unconventional distribution model compared to other car manufacturers where the final sale is made via car dealerships which are not tied to the company.

Why did Tesla use a direct distribution approach?

Back in October 2012, Elon Musk explained in a blog post, the whole philosophy around Tesla’s distribution strategy:

There are reasons why Tesla is pursuing a company owned store and service center model that we feel are really important. In many respects, it would be easier to pursue the traditional franchise dealership model, as we could save a lot of money on construction and gain widespread distribution overnight. Many smart people have argued over the years that we should do this, just like every other manufacturer in the United States, so why have I insisted that we take a unique path?

Some of the key elements that made Tesla go with this strategy, which was way more expensive, and hard in the short-term was:

Conflict of interest of franchise dealers

For traditional car dealers, gasoline cars constituted the vast majority of their business. Thus, the franchise dealer would have been in a conflict of interest in offering a Tesla product, as this would have required them to contrast their core business model.

Ability to educate and channel the customer toward choosing Tesla over established brands

As Elon Musk highlighted back in 2012: “Tesla, as a new carmaker, would therefore rarely have the opportunity to educate potential customers about Model S if we were positioned in typical auto dealer locations.”

So Tesla built its own stores, located in central places (similar to Apple stores’ distribution or perhaps branding strategy) to educate and enable potential customers to place orders, but primarily as a long-term objective to educate consumers about the brand and the potential of electric vehicles.

Today, after almost a decade of this strategy, Tesla is among the most recognized brands, and its stores are places that people enjoy visiting, as the electric vehicles proposed by Tesla have become iconic.

Freedom to open direct stores anywhere

With a traditional distribution strategy, it would have been easy for Tesla to run in conflict with franchised stores, by opening direct stores in close proximity. By having only a direct distribution, Tesla doesn’t have such a problem.

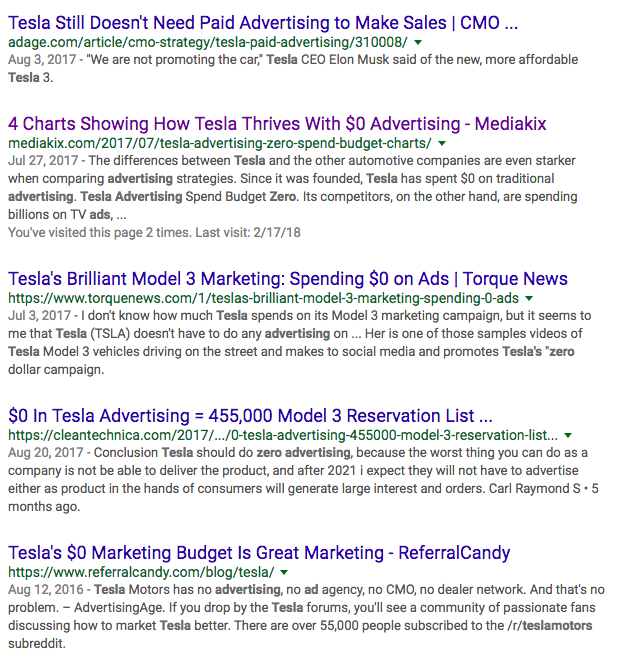

Does Tesla spend nothing on marketing?

Musk is famous for his unconventional stunts. For instance, the stunts of the flamethrowers or the Tesla roadsters sent on space managed to reach hundreds of millions of people worldwide without a dollar spent on ads.

However, this also fueled the myth that Tesla doesn’t spend a dollar on advertising campaigns or marketing.

Like any other company, Tesla has a marketing budget for advertising and marketing campaigns. As an example, in 2018 Tesla reported its “Marketing, Promotional and Advertising Costs:”

Marketing, promotional and advertising costs are expensed as incurred and are included as an element of selling, general and administrative expense in the consolidated statement of operations. We incurred marketing, promotional and advertising costs of $70.0 million, $66.5 million and $48.0 million in the years ended December 31, 2018, 2017 and 2016, respectively.

Thus, even though the former PayPal Mafia member Elon Musk is the master of unconventional PR, Tesla still needs advertising to push its sales.

However, if we compare that to the revenue figures for 2018 (over $21 billion), the spending on marketing activities is around 0,3% which is an incredibly low figure, almost negligible, considering that large companies like Tesla spend billions of dollars in branding campaigns!

Based on that, we can indeed affirm, that it’s like Tesla doesn’t have a marketing budget at all! And we’re talking about a company that passed a trillion-dollar in market cap!

Tesla manufacturing explained

Thousands of purchased parts are sourced from hundreds of suppliers across the world. For the key parts (battery cells, electronics, and complex vehicle assemblies) Tesla developed closed ties.

For most car manufacturers, components to build the cars, are often single-supplied. Other parts are instead available from multiple sources. So to diversify the suppliers’ components as car manufacturers also Tesla can experience high volatility in sourcing the components for its cars.

To prevent that, Tesla either looks for multiple sources or can stock up inventories of components.

Is Tesla worth more than GM?

In January 2020, Tesla passed for the first time in its history the market cap of $100 billion, twice the market cap of GM (about $50 billion) in the same period even though in 2018 GM had 6-7 times the revenues of Tesla. Tesla though is valued as a tech company, which in the future can capture a wider and wider market, thus becoming way more valuable.

By October 2021, Tesla’s market cap would be 10x, reaching over a trillion-dollar! This in part, was due to the fact that the company managed to successfully pass the mass manufacturing stage.

Undoubtedly, Tesla is getting valued as a tech company, an electric energy platform (not much different from its oil equivalent: Exxon or Chevron), and a company that might generate hundreds of billions in sales in the coming years. This is the bet markets are making.

Tesla as a business platform

Looking at Tesla just as a company it’s a limited view. Tesla is much more than that. The company is a business platform, meaning it doesn’t just make and sell cars, but it is also an energy generation and storage platform. So it’s both a pipeline and a platform. To understand that let’s see the various components that make Tesla up as a company.

Breaking down Tesla’s competitors

Tesla isn’t just an automaker; it is an electric-only car automaker, an electric storage company, and an autonomous driving player. For that, we’ll have to analyze Tesla from these three perspectives.

Automaking

Within the automaking segment, Tesla has over the years diversified its products‘ lines, to cover different segments of the market. When Tesla entered the market, as a go-to-market strategy it had to enter it (nonetheless Elon Musk’s long-term vision to make the electric car available to the masses) with the Roadster model.

While this model is still available, this is the highest-priced model and the product Tesla used to bootstrap its operations. Indeed, at the time, Tesla couldn’t produce a lower-cost electric car (Model 3 will finally achieve this goal), and that is how Tesla made its business model viable as it entered the new market for electric cars. This is what I call a transitional business model:

Over the years, as the market matures, Tesla grew, an electric ecosystem was born, and the technology to enhance battery performance improved, Tesla also expanded its products lines to cover the various segments.

Sport & Performance

The primary models covering these segments are:

- Roadster: here some of the competitors are Dodge Challenger, Porsche Chiron, and Bugatti

- Model S: in this segment, Tesla competes with players like Mercedes S-Class, BMW 7 Series, Porsche Panamera, Audi A7 & A8, and more.

Suv

The primary models covering these segments are:

- Model X: here some of the competitors are BMW X5, Mercedes-Benz GLS-Class, Volvo XC90, Porsche Cayenne.

- Model Y (compact SUV): in this segment, Tesla competes with Renault Zoe, Nissan LEAF, Volkswagen e-Golf, Audi e-Tron, and more.

Truck

In this segment, Tesla just launched the Cybertruck:

Cybertruck’s competitors comprise Rivian, Ford, Bollinger.

City Car

Tesla has finally its mass-market product, the Model 3. This model competes with models such as BMW Series 2,3,4,5 Mercedes Class C, CLA, CLS, Audi A3, A4, A5, Lexus, ES, GS, and many others.

Energy Storage

Tesla acquired SolarCity back in 2016, for $2.6 billion, and with that, it competes in the electric production and storage industry with players like SunRun, SunPower, Vivint Sonar, Trinity Solar, and SolarWorld to mention a few.

Autonomous driving

Tesla’s Autopilot is one of the key ingredients of its technology and one of the most interesting future developments for the company. In this segment, Tesla competes with other autonomous driving companies like Zoox (bought by Amazon), Waymo (an Alphabet bet), and Baidu.

Why do the automotive regulatory credits matter for Tesla?

Automotive Regulatory Credits generated over $1.4 billion in revenues for Tesla in 2021, compared to just 594 million in 2019.

How do they work? Since Tesla produces zero-emission vehicles (“ZEVs”), these credits are sold to other regulated entities “who can use the credits to comply with emission standards and other regulatory requirements.”

As Tesla ramps up its operations, those regulatory credits revenues will also grow together with the increased production of cars.

In fact, the credits are directly linked to Tesla’s new vehicle production.

This revenue stream is extremely important, because (even if small for now) it’s completely free. This means, there is no additional effort/cost for the company is having these credits, it only needs to produce more EVs.

And as the production scales, this number will grow exponentially, thus boosting the company’s profitability and cash flows (at least until this regulation will last)!

Why Tesla’s mass scale is all about the demand side!

In the last decade, Tesla had to make sure it could build its ability to mass-scale production, in what Elon Musk has labeled as “mass-production hell.”

Indeed, after being able to make the first prototype, the challenge Tesla had was to enable production at scale.

This effort, of the last decade and more, actually was about to bankrupt the company on several occasions (the last one in 2018, when Tesla was a few days away from running out of cash).

Yet, things turned around, starting in 2019, and in particular, 2021-2022 were key years. Indeed, Tesla managed to ramp up its operations through the opening of Shangai, Berlin, and Texas gigafactories.

This, made Tesla mostly pass through the hurdle of the mass manufacturing hell.

Now, it gets all about the ability of Tesla to make its cars affordable at scale, which can either happen by lowering the prices (but it would be a process that might require years and not sustainable in the long-term) or by enabling a part of the business to subsidize another part of this business.

This can be achieved through the leasing and insurance arms of Tesla.

In short, by borrowing the iPhone’s playbook, Tesla can enable a wide/mass distribution for its cars. But primarily developing its own leasing and insurance arm.

And for some context, in 2021, the leasing and service arm (powered up by the insurance offering) passed the $5 billion dollar mark!

Key takeaways

- Back in 2008, Tesla used a go-to-market strategy by targeting a small segment of the automotive industry (sports car) as it could offer at the time competitive options to customers in that segment.

- In 2012, Tesla started to roll out its long term mission to have electric cars, mass-produced with the launch of its Model S. This strategy is still getting rolled out, and as Tesla gains more market shares and build a more viable electric ecosystem it can also reduce its pricing, thus increasing the mass adoption for its cars.

- Tesla uses a direct distribution model where it sells directly through its e-commerce and physical stores across the world.

- Tesla also offers new vehicle sales with customers’ trade-in needs for its existing Tesla and non-Tesla vehicles. The Tesla and non-Tesla vehicles acquired through trade-ins are remarketed, either directly by Tesla or via third parties.

- Tesla also owns several manufacturing facilities where it either single-source certain components or it diversifies components sources. Where possible Tesla stacks up components to reduce the risk and volatility of the supply chain.

- Tesla’s distribution strategy combined with its appeal as consumer brand with products like Model 3, priced with a base price for mass-market appeal, makes Tesla among the most valuable car manufacturers in the world.

Read Also: Tesla SWOT Analysis, Transitional Business Models, Tesla Mission Statement.

Business resources:

- The Ultimate Guide to Market Segmentation

- What Is a Business Model?

- The Complete Guide To Business Development

- Business Strategy Examples

- What Is a Business Model Canvas? Business Model Canvas Explained

- Blitzscaling Business Model Innovation Canvas In A Nutshell

- What Is a Value Proposition? Value Proposition Canvas Explained

- What Is a Lean Startup Canvas? Lean Startup Canvas Explained

- Marketing Strategy: Definition, Types, And Examples

- Marketing vs. Sales: How to Use Sales Processes to Grow Your Business

- How To Write A Mission Statement

- What is Growth Hacking?

- Growth Hacking Canvas: A Glance At The Tools To Generate Growth Ideas

Case studies:

- Tesla Mission Statement

- Who Owns Tesla

- Tesla SWOT Analysis

- How Does PayPal Make Money? The PayPal Mafia Business Model Explained

- How Does Venmo Make Money? the Peer-To-Peer Payment App for Millennials

- How Does WhatsApp Make Money? WhatsApp Business Model Explained

- How Does Google Make Money? It’s Not Just Advertising!

- How Does Facebook Make Money? Facebook Hidden Revenue Business Model Explained

- Marketing vs. Sales: How to Use Sales Processes to Grow Your Business

- The Google of China: Baidu Business Model In A Nutshell

- Accenture Business Model In A Nutshell

- Salesforce: The Multi-Billion Dollar Subscription-Based CRM

- How Does Twitter Make Money? Twitter Business Model In A Nutshell

- How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

- How Amazon Makes Money: Amazon Business Model in a Nutshell

- How Does Netflix Make Money? Netflix Business Model Explained

Related To Tesla Business Model

![The History of Tesla, With Tim Higgins [FourWeekMBA Podcast] history-of-tesla](https://i0.wp.com/fourweekmba.com/wp-content/uploads/2022/03/history-of-tesla-150x150.png?resize=150%2C150&ssl=1)