Tesco was founded in 1919 by Jack Cohen, as a small group of market stalls. After rapid expansion in the following years, the company became the largest retailer in the UK and is now the second-largest in the world. To put their dominance into perspective, consider that Tesco serves around 66 shoppers per second across 7000 retails stores, delivering approximately $180,000 worth of sales every minute.

Strengths

- Market share – Tesco dominates the grocery retail sector in the United Kingdom, with a 27% market share.

- Market diversification – Tesco has diverse product offerings, including clothing, homewares, school uniforms, cell phones, and financial services.

- Technology integration – Tesco supermarkets are supermarkets of the future. The company uses automated barcode stocktake systems and has developed an app to streamline its customer shopping experience.

- Resilience – the company has significant cash reserves and a large property portfolio, allowing it to be more resilient.

- Longevity – Tesco has been operating in the United Kingdom for over 100 years. This gives the company brand equity and gives consumers assurance that it will continue to operate long into the future.

Weaknesses

- Unprofitable subsidiaries – although diversified, Tesco remains vulnerable to external factors that affect profitability. For example, the finance arm of the company was impacted by the recent UK credit crisis and has not recovered.

- Global appeal – although Tesco operates in several European and Asian countries, its attempts to gain a foothold in the USA and Japan failed. This suggests that the company has some difficulty in assessing the viability of overseas markets.

- Economic mismanagement – in 2015, Tesco overstated their income by GBP 208 million, leading to the resignation of the CEO and substantial damage to the brand and its stakeholders.

- Competition – Tesco is more susceptible to competitive pressures in the food and retail industry because of its low-cost business model with small profit margins.

Opportunities

- Expansion – there are several emerging economies that Tesco can explore, such as Indonesia, Turkey, and Brazil. Nevertheless, any such expansion plans would need to be researched and planned for thoroughly.

- Online shopping – although Tesco has some presence in eCommerce, there exists the potential for the company to increase its visibility online. Through offering a more diverse range of non-food products in a non-physical store, profit margins might be higher.

- Strategic alliances – to counter the introduction of German low-cost supermarket chains such as Aldi and Lidl, Tesco might form strategic partnerships with other companies to attract more customers and increase market share.

Threats

- Consistent negative press – Tesco has been involved in several scandals that have permanently impacted on their brand image. In addition to under-reporting profits, the company faced social media backlash in 2017 after airing a Christmas TV advertisement that disrespected the Christian faith. In the same year, Tesco was also accused of creating fake farm names in its food marketing campaigns.

- Brexit – now that the UK has left the European Union, Tesco is at the mercy of revised trade deals that may render traditionally reliable European markets to be unprofitable.

- Competition – although Tesco enjoys a large market share in the UK, competitors such as Sainsbury’s are actively trying to close the gap. Tesco’s other main competitor, ASDA, has also been acquired by Walmart – strengthening its market position and putting further pressure on Tesco.

SWOT Analysis Case Studies

Read Next: SWOT Analysis, Personal SWOT Analysis.

Other case studies:

- Amazon SWOT Analysis Example

- Apple SWOT Analysis Example

- Facebook SWOT Analysis Example

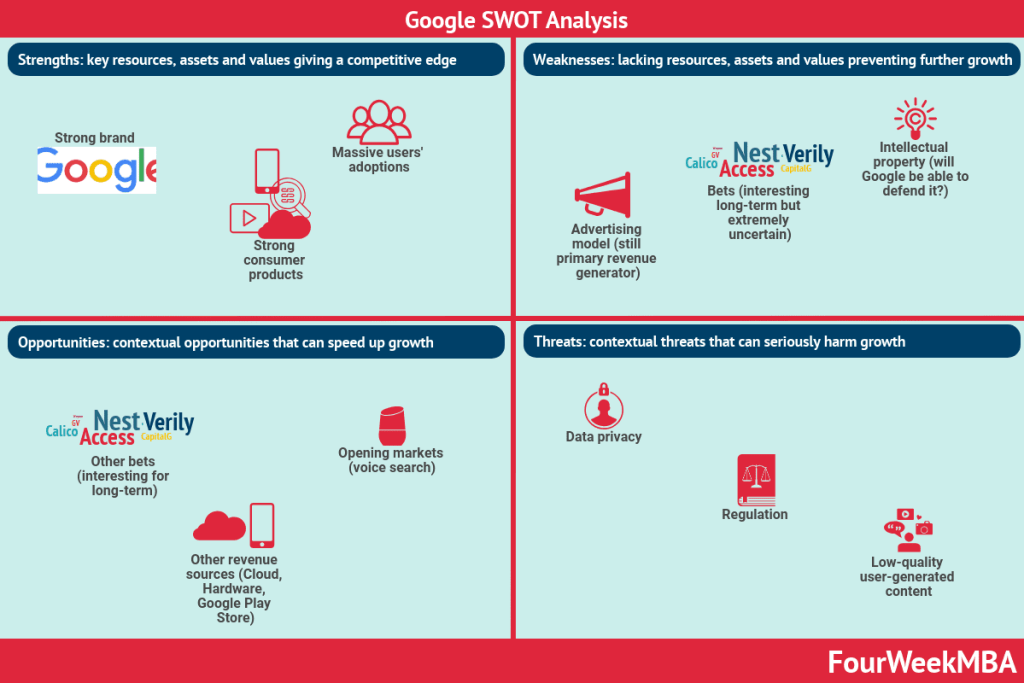

- Google SWOT Analysis Example

- Netflix SWOT Analysis Example

- Starbucks SWOT Analysis Example

- Tesla SWOT Analysis Example

Other resources: