Founded in 1975 by Bill Gates and Paul Allen, Microsoft is a revolutionary company in the world of personal computing. The company designs and manufactures software, hardware, operating systems, apps, and devices. Indeed, Windows and Microsoft Office are staples in billions of homes worldwide.

Here is a SWOT analysis that gives a general idea.

Strengths

- Market share – Microsoft is the #2 ranked company in the world with a market value of $1,359 billion. More than half a billion devices across 190 countries use the Windows operating system. Microsoft is also making significant gains in cloud services despite being a late adopter of the technology, taking valuable market share from Amazon.

- Large product portfolio – compared to its nearest competitor Apple, Microsoft has a large and diverse range of products. Aside from the well-known operating systems and software programs, Microsoft also sells video games, tablets, entertainment consoles, and other intelligent devices.

- Strong leadership – CEO Satya Nadella has implemented bold and effective leadership since taking the position in 2014. He has overseen massive restructuring and reinvention of the company including a renewed focus on mobile-based technology and the expansion of Microsoft services to be compatible with Mac.

Weaknesses

- Lack of innovation – some view a lack of innovation as one of Microsoft’s primary weaknesses. For example, many of its customers are running very old versions of Windows that the company no longer supports. This impacts on Microsoft’s ability to sell new versions of Windows and remain competitive with more advanced Apple products.

- Security flaws – historically, Microsoft Windows has been more susceptible to viruses and cybercrime when compared to other operating systems. This puts the company at a distinct competitive disadvantage.

- Failed acquisitions – many of Microsoft’s recent acquisitions have been questionable. For example, Microsoft acquired Nokia for $7 billion at a time when Nokia had lost its entire market share to Apple and Samsung. The company also acquired Skype for $8 billion and despite the platform enjoying increased usage, Microsoft has not been able to make it financially viable.

Opportunities

- Product affordability – many Microsoft products have a notoriety for being overpriced – especially in comparison to low-cost or free alternatives. For example, Microsoft Office costs $150 for a one-time installation while the open-source Apache OpenOffice provides the same software for free. By lowering prices or bundling services, Microsoft could increase market share considerably.

- Smart acquisitions – instead of acquiring businesses with no viability, Microsoft could use its large cash reserves to acquire or at least form partnerships with young, innovative start-ups that bring a different skill set and perspective to the company. One example, at an enterprise level, was the acquisition of GitHub. And another example was the acquisition of LinkedIn.

Threats

- Changing consumer habits – with a limited presence in the mobile market and a consumer shift away from PCs and laptops, Microsoft’s reliance on operating systems is under direct threat.

- Counterfeit software – low-quality imitation or counterfeit products continue to be a problem for Microsoft, particularly in emerging and low-income markets. This is no doubt exacerbated by Microsoft’s high product prices and vulnerability to cybercrime.

Read Next: Microsoft Business Model, Who Owns Microsoft?, Microsoft Organizational Structure, Microsoft SWOT Analysis, Microsoft Mission Statement, Microsoft Acquisitions, Microsoft Subsidiaries, Bill Gates Companies.

Related Visual Stories

Microsoft Revenue Per Employee

Microsoft Organizational Structure

OpenAI Organizational Structure

Stability AI Ecosystem

SWOT Analysis Case Studies

Read Next: SWOT Analysis, Personal SWOT Analysis.

Other case studies:

- Amazon SWOT Analysis Example

- Apple SWOT Analysis Example

- Facebook SWOT Analysis Example

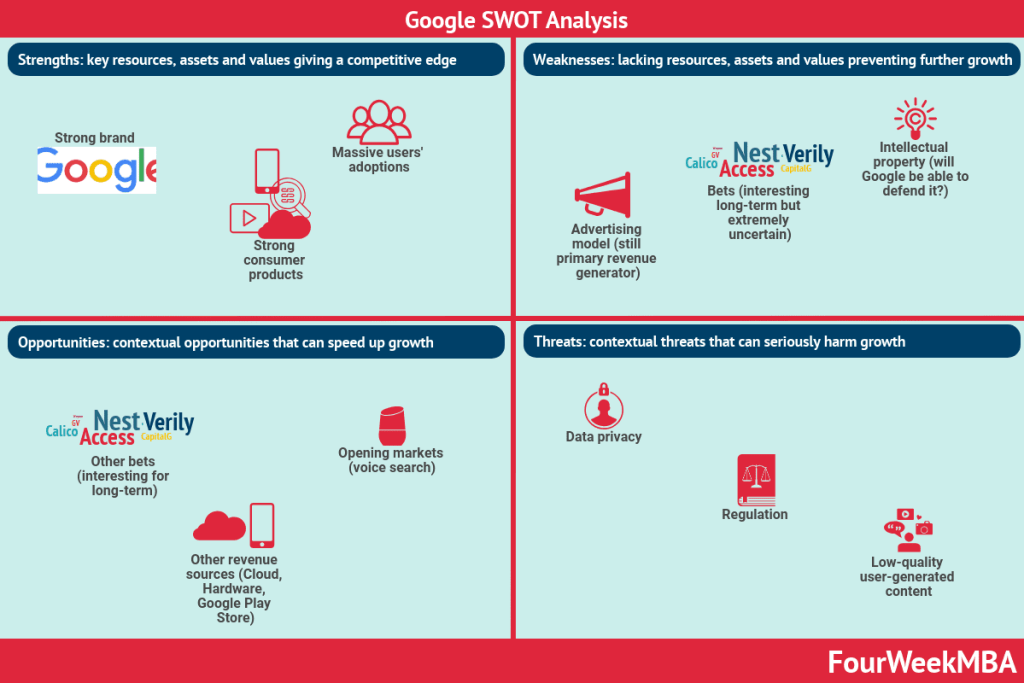

- Google SWOT Analysis Example

- Netflix SWOT Analysis Example

- Starbucks SWOT Analysis Example

- Tesla SWOT Analysis Example

Other resources: